The law by default, calls for the dissolution of a partnership (the end of the partnerships life) when partners change or withdraw. However, a partnership may change the number of partners by agreement. There are two general ways that new partners may be added to a partnership. The first way is when a new partner buys out the interest of another partner who leaves the partnership. The second way is when a new partner contributes new capital, increasing the number of partners in the partnership.

Buying Out an Existing Partner

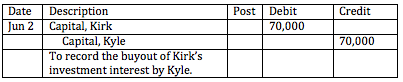

When a new partner buys out an existing partnerships interests, the name of the partner's capital account must change. This occurs using a simple journal entry. For example, if Kyle buys out Kirk's interest in Muskoka Brewery, Kyle will pay Kirk directly and the only journal entry recorded in the partnership is to change the name of the account. No cash comes in or goes out of the partnership.

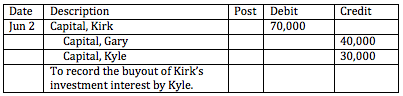

In other cases an existing partner may help buy out the other partners share. For example, both Gary (the existing partner) and Kyle may both pay Kirk for part of his interest in the partnership. Therefore, when Kirk leaves the company, both Kyle and Gary will get a portion of his interest.

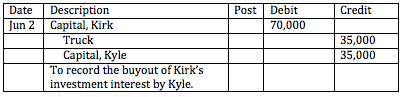

In the third instance, Kirk may withdraw a portion of his investment from the partnership when he leaves (either in cash, or by taking an asset for personal use). For example, Kirk may take the truck from the firm. This would reduce the book value of his capital account by $35,000. As a result, when Kyle buys out Kirk's interest the balance of his new capital account would only be $35,000.

When existing partners buy out another partner in the firm, the partner's capital account is divided between the remaining partners. In some circumstances, a partner may agree to transfer his interest in the partnership in exchange for assets of the firm with a book value worth more or less than the value in the partner's capital account. Any increase or decrease in capital resulting from the trnsaction should be shared between the remaining partners in the proportion that they agreed to share profits and losses in the partnership agreement.

Direct Investment from a New Partner

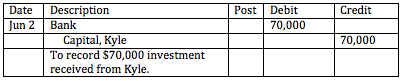

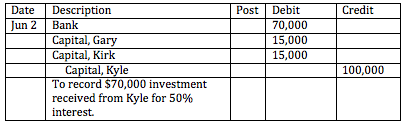

A new partner may want to invest directly in the partnership without buying out an existing partner. When this occurs, a new capital account must be made for the new partner. For example, intead of buying out Kirk's interest our example Kyle decides to invest $70,000 cash directly in the brewery. The following journal entry would be recorded.

In this example, Gary currently has $60,000 invested in the firm, Kirk has $70,000 invested in the firm, and now Kyle has invested another $70,000. It may however happen where a new partner makes an investment in the partnership and gains an interest that is greater than his investment. For example, in order to get Kyle to invest in the partnership, Gary and Kirk may agree to give Kyle a 50% interest in the partnership. This means that by investing $70,000, the book value of Kyle's interest in the firm will be $100,000, or 50% of the $200,000 equity in the partnership. The difference must be deducted from Gary and Kirk's own capital accounts in the same proportion that they have agreed to share income and losses (in this case, 50/50). The following entry would reflect this.

Changes in Partners

BrainMass Solutions Available for Instant Download

Death or Retirement of a Partner

PARTNERSHIP ACCOUNTS CHANGE IN THE PARTNERSHIP RETIREMENT OF A PARTNER QUESTION A summary balance sheet for the Singh, Deonarine, and Maharaj partnership on December 31, 2011 is shown below. Partners Singh, Deonarine, and Maharaj allocate profit and loss in their respective ratios of 3:2:1. The partnership agreed to pay part