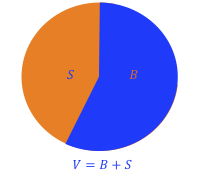

Does capital structure affect firm value? The value of a firm is equal to the sum of a firm's debt and equity. We often look at the value of the firm as a pizza or a pie, where the value of the firm equals the size of the pie, S is the value to shareholders and B is the value to bondholders. Our goal is to find a debt-to-equity ratio that maximizes firm value.

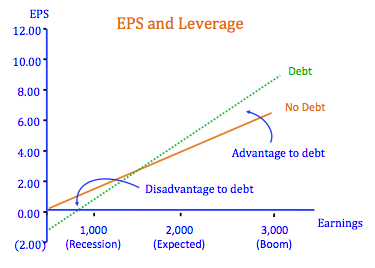

A firm's capital structure is not fixed. That is, a firm can increase it's debt to equity by issuing bonds and buying back shares, or vica versa, by issuing shares and using the proceeds to pay of debt. Because the amount of interest paid to bondholders is fixed, any returns above the interest rate accrue to shareholders. That is, if a firm leverages up (issues debt to buy back shares), and proceeds above the interest paid to bondholders will be kept be the remaining shareholders. Therefore, if earnings are high (such as in a boom period), a leveraged firm's income will be split between fewer shareholders, increasing EPS. However, if earnings are low (such as in a recession), the amount that the firm has to pay out to bondholders remains the same, so EPS will decrease.

But does this necessarily mean that firm value will go up with more leverage, or does leverage just make the returns to shareholders more risky? In fact, an investor could borrow to invest in an unlevered firm, and duplicate the payoff from a levered firm. This is the insight behind the theory Modigliani and Miller (M&M) Proposition I.

Modigliani and Miller (M&M) Proposition I (Without Taxes): Capital structure decisions do not matter to shareholders. The value of a firm is defined by its cash flows; capital structure only determines who receives this cash flow. As we often hear students remark: "cutting up a pizza may make more slices, but it doesn't make more pizza."

VL = VU

Where,

VL = Value of the unlevered firm

VU= Value of the levered firm

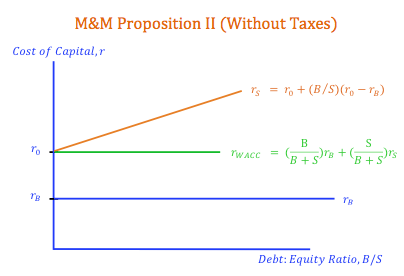

Modigliani and Miller (M&M) Proposition II (Without Taxes): As we showed before, leverage does increase the risk and return to shareholders.

Where,

rS = return to shareholders

r0 = rate of return of an unlevered firm

rB = rate of return to bondholders (interest rate)

B/S = debt-to-equity ratio

If this is the case, that capital structure has no affect on firm value, why is it then that firm's seem to pay a lot of attention to their capital structure. The answer is taxes. Because interest payments on debt are tax deductible, financing a firm with debt provides what we call a tax shield, that is, a firm that pays interest pays less in taxes then it would if it were unlevered. This increases the cash flows that the firm keeps, increasing the value of the firm.

Modigliani and Miller (M&M) Proposition I (With Taxes): Capital structure does have an affect on firm value. Firm value increases with leverage by the present value of the tax shield (TCB).

VL = VU + TCB

TC = Tax rate

B = Value of debt

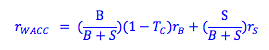

Modigliani and Miller (M&M) Proposition II (With Taxes): Although shareholder risk and return increases with leverage, some of the increase in risk is offset by the interest tax shield.

WACC (With Taxes): Because interest is tax deductible, the cost of debt, r, is equal to r(1-TC) after taxes. With a lower cost of debt, a firm's weighted average cost of capital is lower. Because the cost of capital for a levered firm vs. an identical unlevered firm, is lower, it will have a higher firm value.

Photo by Lukas Blazek on Unsplash

© BrainMass Inc. brainmass.com July 26, 2024, 8:02 pm ad1c9bdddf