In finance, an annnuity is a stream of periodic, fixed payments received over a specific period of time. We use time value of money concepts, such as present value and future value, to value this stream of payments. A perpetuity is an annuity that continues forever - or at least indefinitely into the future. We use a modification of the formula for present value of a perpetuity to value and annuity.

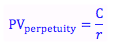

The present value of a perpetuity is simply equal to the payment, C, divided by the rate of interest.

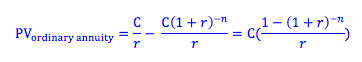

The present value of an annuity is equal to the present value of the equivalent perpetuity; however, we subtract a second perpetuity equal to the amount that the additional stream of payments would have been worth if they had not stop at the specified date. We can simplify this formula as follows:

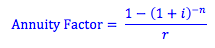

The portion of the formula that appears after the C is often referred to as the annuity factor. Annuity factors are often presented in table form to allow for easy calculations for the present value of the annuity.

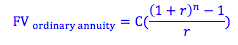

The future value of an annuity can be found similarly:

An ordinary annuity refers to an annuity that has its first payment one year from now. It is contrasted with an annuity due, which has an immediate first payment. In order to find the present or future value of an annuity due, we multiply the value of the ordinary annuity by (1+r), in order to 'bring the cash flows forward one period.'

Photo by Pawan Kawan on Unsplash

© BrainMass Inc. brainmass.com June 30, 2024, 7:45 am ad1c9bdddf