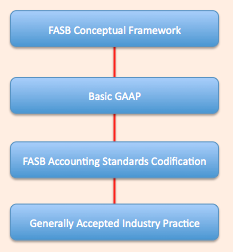

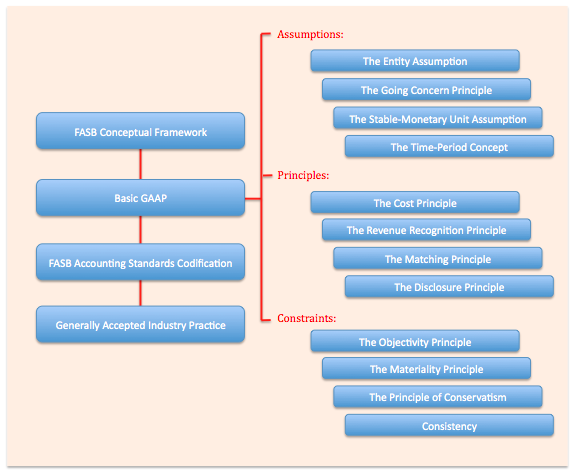

Three Levels in the Accounting Framework

The discipline of accounting can be broken down into a framework with four general levels. First is the conceptual framework which outlines the theory behind accounting rules. Second is a set of basic generally accepted accounting principles (Basic GAAP) that helps guide decision making when applying GAAP. Thirdly, is the FASB Accounting Standards Codification - the complete source of authoritative GAAP, including specific rules set out by FASB and the SEC. Fourthly, and lastly, there exists a level of pre-existing industry practices that are typically followed. Standard industry practices increase the consistency of financial statements for the same firm between periods, and between different firms in the same industry.

Basic generally accepted accounting principles, also known as basic accounting principles and guidelines, form the groundwork from which the more detailed and complicated FASB accounting standards (also known as US GAAP) are based. These guidelines flow from the conceptual framework of accounting, which is the theory that outlines the goals of accounting information and accounting standards. Because US GAAP gives accountants significant leeway in applying accounting rules in different circumstances, understanding this higher-level framework is important to guide decision-making about how specific standards should be applied.

As well, the SEC allows accountants to depart from US GAAP in the situation where applying these standards might lead to misleading information. As a result, accountants cannot just blindly apply the rules of GAAP without understanding the intent behind the rules. This basic GAAP helps clarify how these types of decisions should be made.

Basic Generally Accepted Accounting Principles (GAAP)

BrainMass Categories within Basic Generally Accepted Accounting Principles (GAAP)

Accrual Basis vs. Cash Basis

There are two principle methods of accounting that can be used to keep track of a business's income and expenses in the United States: cash-basis and accrual basis. These methods differ in timing for when transactions (such as sales and purchases) are recognized.

Relevance vs. Reliability

Relevance and reliability are considered to be the two fundamental characteristics of accounting information according to the conceptual framework of accounting. That is, in order for accounting information to be useful to the primary users of the financial statements, we say that it must have both of these attributes, relevance and reliability.

The Revenue Recognition Principle

Recognition is the process of formally incorporating an item into the financial statements of an entity.

The Materiality Principle

The materiality principle recognizes that in some trivial items, following GAAP would be exceedingly expensive or difficult. In these cases, if the item that needs to be reported is non-material then an accountant can depart from GAAP.

The Matching Principle

The matching principle is a guiding principle, not a rule, that suggests that expenses should be recognized in the same period as the revenues that they helped earned are recognized.

The Cost Principle

The cost principle requires that assets on the financial statements of an entity be recorded at historical cost.

The Objectivity Principle

The objectivity principle in accounting suggests that the information that is reported in the financial statements should be supported by objective evidence. This means that the amounts of recorded transaction are verifiable.

The Going Concern Principle

The going concern principle states that the financial statements of an entity should be prepared as if the firm will continue its operations for the foreseeable future.

The Stable-Monetary Unit Assumption

The stable-monetary unit assumption has two parts. The first part requires that transactions must be able to be expressed in form of a currency. The second part assumes that the value of the currency in which transactions have been originally reported remains constant over time.

The Entity Assumption

The entity assumptions requires that all of the transactions of the business and the items reported on the business's financial statement are kept separate from the finances of the business's owners.

The Time Period Concept

The time period concept requires that financial reporting take place over specified periods of time known as fiscal periods.

The Disclosure Principle

The full disclosure principle states that any information that is material, but is not reported in the financial statements, must be disclosed in the notes to the financial statements.

The Principle of Conservatism

The principle of conservatism requires that accountants be allowed to recognize anticipated or potential losses, but should not be allowed the same action to be taken when considering anticipated or potential gains.

Consistency

Consistency requires that once an accounting method is chosen by a firm, the same method should be used from period to period. It also suggests that accountants should strive to use similar accounting methods as other firm’s in the same industry.

BrainMass Solutions Available for Instant Download

Variances, information quality, static and flexible budgets

The photocopying department in a community college has budgeted monthly costs at $40,000 per month plus $7 per student. Normally 800 students are enrolled. During January there were 730 students (which is within the relevant range). At the end of the month, actual fixed costs were $42,000, and variable costs were $3,650. A.

GAAP Violations

Write a memorandum to Francis Bacon explaining how each practice violated GAAP and how each type of transaction affected reported income, financial position and cash flows. Attached are the files and statements.

GAAP Exercises

Hi, I need your assistance with these study guide questions. 1.Which one of the following assertions is not made by management in placing an item in the financial statements? a. existence or occurrence b. direct controls c. rights and obligations d. presentation and disclosure e .completeness 2. If reported sales f

ROI, transfer prices, DuPont Analysis, residual income, GAAP role in transfer prices

1) How can firms use transfer prices strategically? What role does GAAP play in how firms determine transfer prices? 2) Consider the following information about a potential project: Investment required $2,000,000 Expected annual project revenue $3,600,000 Expected annual project expenses $3,200,000 Required rate of retu

GAAP Correct Practices

Which one is not a correct practice under the GAAP? A) ARB 43 noted that there are two separate types of intangibles: those having a term of existence limited by regulation and others and those having no such term of existence B) Goodwill should be amortized as an expense over less than 40 years. C) Generally R&D is rec

GAAP versus IFRS for ETIF Issue

For Issue No. 09-D Application of the AICPA Audit and Accounting Guide, Investment Companies, by Real Estate Investment Companies - Evaluate the difference in accounting treatment between GAAP and IFRS in this area and how the exposure draft recommendation may impact these differences.

What accounting conventions do the two companies follow, US GAAP or IFRS? Apple and Philips.

Part II. Refer to the latest annual financial statements for the two following companies: Apple and Philips. Clearly identify the companies, the time period, and include the link to the financial statements you are analyzing in your report. What accounting conventions do the two companies follow, US GAAP or IFRS? Wh

Is there a difference in approach to valuation by US GAAP and IFRS?

Reviewing balance sheets in detail. Is there a difference in approach to valuation by US GAAP and IFRS? Discuss and note two specific differences. In addition, briefly: ? Distinguish between an expense (expired cost) and an asset. ? Distinguish between current and long-term assets. ? Distinguish between current and long-

Difference in approach to valuation by US GAAP and IFRS?

Is there a difference in approach to valuation by US GAAP and IFRS? Discuss and note two or three specific differences. In addition, briefly: - Distinguish between an expense (expired cost) and an asset. - Distinguish between current and long-term assets. - Distinguish between current and long-term liabilities. - Review

Fund accounting

Does it make sense to you the use of fund accounting for state & governmental transactions instead of using GAAP? Why? Please cite reference/source.

externally presented reports; GAAP; misstatements

Why are externally presented reports required to be prepared according to generally accepted accounting principles while internally presented managerial accounting reports are not? How can a misstatement in one financial statement, whether intentional or not, affect a presentation in another financial statement? Give an examp

Identify and describe the sources of generally accepted accounting principles

-Topic 1: Identify and describe the sources of generally accepted accounting principles. Identify source hierarchy and explain why the hierarchy is important. -Topic 2: Describe effective accounting information using the qualities of accounting information from your readings this week. -Topic 3: Describe how an accrual based a

Pearl Inc: calculate PAST service costs and net pension expense under IAS 19 and US GAAP

Pearl Inc., a calendar-year entity, amends its defined benefit pension plan on January 1, 2009 and must recognize the increase in past service costs of its vested and non-vested employees as of that date in the calculation of its net 2012 pension expense (or revenue). The pertinent facts as of January 1, 2009 are: Increase in

Using Accounting Databases to Obtain Relevant Data The use of accounting databases enables researchers to obtain data to help answer their questions more efficiently. Using the FASB Codification database and other sources such as the SEC Web site as guides, answer the following questions: (1) How might an accountant ensure that all relevant accounting standards and other authoritative literature relevant to an accounting research question have been identified? (2) What techniques or methods would ensure such identification? (3) What sources would you use to locate GAAP?

Using Accounting Databases to Obtain Relevant Data The use of accounting databases enables researchers to obtain data to help answer their questions more efficiently. Using the FASB Codification database and other sources such as the SEC Web site as guides, answer the following questions: (1) How might an accountant ensure

Externally presented reports, GAAP, and misstatements

Why are externally presented reports required to be prepared according to generally accepted accounting principles while internally presented managerial accounting reports are not? How can a misstatement in one financial statement, whether intentional or not, affect a presentation in another financial statement? Give an examp

GAAP Application - Conceptual Framework of Accounting: Match terminology and concepts to situations

Unit 6 GAAP Application-Conceptual Framework of Accounting The Conceptual Framework allows for the systematic adaptation of accounting standards to a changing business environment. The FASB uses the conceptual framework to aid in an organized and consistent development of new accounting standards. The conceptual framework outlin

GAAP Application - Conceptional Framework of Accounting

The Conceptual Framework allows for the systematic adaptation of accounting standards to a changing business environment. The FASB uses the conceptual framework to aid in an organized and consistent development of new accounting standards. The conceptual framework outlines the objectives of financial reporting and the qualities

IFRS and GAAP Reporting Standards

For convergence of FASB and IASB reporting standards, you describe recommendations for resolving differences and your opinion which is better for company. 1. Revenue Recognition, 2. Fair Value, 3. Pension and Retirement Benefits, 4. Leases and Cash Flows

What are different ways to estimate bad debt?

What are the different ways to estimate bad debt? How does this affect net income? What does Generally Accepted Accounting Principles (GAAP) require? Why? Should all companies have bad debt? Explain your answer.

Preference for rules of book vs tax; US GAAP vs IFRS

If the US transitioned from separate accounting rules for book and tax purposes to one set of rules for both, which set of rules might be selected and why? How might the pending transition from US GAAP to IFRS impact your decision, if at all?

How do GAAP and IFRS differ?

The U.S. is scheduled to begin moving from Generally Accepted Accounting Principles (GAAP) to IFRS by 2014. At least three questions are worth discussing: 1. How do GAAP and IFRS differ? 2. What might the consequences be for financial managers, apart from financial reporting / controllers? 3. The IFRS move was

Five components of pension expense; US GAAP vs IGAAP

Identify the five components that comprise pension expense. Briefly explain the nature of each component. What is a private pension plan? How does a contributory pension plan differ from a noncontributory plan. Briefly describe some of the similarities and differences between US GAAP and IGAAP with respect to the accountin

Examine the sources of pressure that change and influence the development of GAAP.

Examine the sources of pressure that change and influence the development of GAAP. Determine the sources of pressure that have the greatest impact. Justify your rationale. Determine the organization that has the greatest impact in developing GAAP. Justify your rationale.

What is the purpose of GAAP and management accounting? and more.....

1. What is the purpose of GAAP and management accounting? There is a very important distinction that we need to keep in mind when discussing accounting because... they are not the same 2. Can you of any example of non GAAP statements that are beneficial to companies and why non GAAP financial statements, may be necessary?

Identify three major accounting issues on which IFRS and US GAAP currently differ.

1. Identify three major accounting issues on which IFRS and US GAAP currently differ. For each, outline briefly the nature of the divergence, and discuss the potential impact if the IFRS position is adopted in the US.

GAAP as applied to the health care industry

Explain generally accepted accounting principles applied to the health care industry and how they are applied to your Operating Budget Projection.

Intercompany transactions under IFRS vs US GAAP

IFRS is principle based accounting standards unlike the rule based US GAAP. Can you cite one or two examples of this fact using the accounting for intercompany transactions.

This post addresses GAAP, bad debt, and related issues.

What does Generally Accepted Accounting Principles (GAAP) require? Why? Should all companies have bad debt?

GAAP

What are Generally Accepted Accounting Principles (GAAP)? How does GAAP affect financial reporting? How does GAAP need to change to accommodate today's dynamic business environment?

Generally accepted accounting principles (GAAP) and health care

Some generally accepted accounting principles (GAAP) apply only to health care, and there are many health care organizations that use other comprehensive bases of accounting when GAAP does not apply -- for instance, an HMO that must report to a government regulatory agency using that agency's guidelines instead of GAAP. What is