Sales tax is levied by the government on the sale or lease of certain goods or services. Most states levy sales taxes, although the products and services that are taxed and the tax rate vary significantly between states. Sales tax is collected from customers by retailers and service providers and must be remitted to the appropriate government. When it is collected, sales taxes payable are a liability.

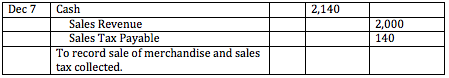

In our example, a retail company sells $2,000 worth of merchandise to a customer. If the state levies a 7% sales tax, customers will pay $2140, including $140 of sales tax. The company will collect this sales tax on behalf of the appropriate government.

Some businesses may be required to remit sales tax when they do their income taxes at the end of the year. Others may be required to remit sales taxes in installments throughout the year. When the company remits its sales tax payable to the government, cash will be reduced and the sales tax payable liability will be reduced.

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Accounting for Liabilities

- /

- Current Liabilities

- /