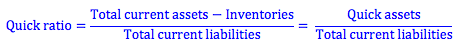

The quick ratio is found by subtracting inventories from current assets and dividing this total (called quick assets) by the firm’s current liabilities. This makes the quick ratio very similar to the current ratio.

Imagine the firm’s current liabilities all became due tomorrow. Because inventory takes time to sell, we exclude it from the quick ratio. We should however expect our accounts receivable to be collected fairly soon (or we could factor our accounts receivable – that is, sell our investment in customer credit to a third party). As a result, the quick ratio gives us a better idea than the current ratio of the firm’s immediate ability to cover its short-term liabilities.

If a firm’s quick ratio goes down, we would be concerned about the firm’s continuing ability to cover its short-term liabilities. If the quick ratio drops below 1, we would be very concerned about the firm’s immediate ability to pay its debts when they become due.