In accounting for contracts, the basic accounting policy decision is the choice between two generally accepted methods: the percentage-of-completion method including units of delivery and the completed-contract method.1

Percentage-of-completion method: Revenues and gross profit are recognized each period based on the construction progress. Construction costs plus gross profit earned to date are accumulated in an inventory account called Construction in Process, and progress billings are accumulated in a contra inventory account called Billings on Construction in Process.

Completed-contract method: revenues and gross profit are recognized only when the contract is completed. Like the percentage of completion method, construction costs are accumulated in an inventory account called Construction in Process, and progress billings are accumulated in a contra inventory account called Billings on Construction in Process.

According to U.S. GAAP, a company should use the method for recognizing contract earnings that best matches revenues to the worked perform, in the period that that worked is performed. For example, if performance of a contract requires a continuous earning process over more than one period, the percentage of completion method should be used. Conversely, the completed contract method should be used if the performance of a contract requires one critical event (a discrete earnings process), if the continuous earnings process occurs within one period, or if the revenues from a continuous earnings process are not measurable.

The Percentage of Completion Method

1. Estimating Total Revenues

The main idea behind the percentage-of-completion method is that the total revenues from the contract should be allocated over the different periods during which work was done on the project. In order to allocate total revenues, we first need some idea of what those total revenues are going to be. You might think this would be easy - just look at how much the contract is worth. Nothing in accounting, however, is ever that simple.

According to U.S. GAAP, in addition to the basic contract price, total revenues also often include items such as contract options, change orders, claims, and contract provisions for penalties and incentive payments, including award fees and performance initiatives. The factors, along with other special contract provisions, must be evaluated (and constantly re-evaluated over the life of the contract) in order to estimate total revenues.2

2. Estimating Percentage-of-Completion

Once we have an idea of what are total revenues are, we want to know how much of the project was completed each period so we can allocate the total revenues accordingly. Contract managers, or their accountants, typically do this by choosing to measure progress towards completion based on either one input measure or output measure. An input measure is an item such as costs incurred or labour hours worked. An output measure is an item such as tonnes produced, storeys of a building completed, or kilometers of a highway paved.

Once we choose our unit of measure, we need to estimate the total units that are needed to complete the contract. For example, the most common way to measure progress towards completion is on a cost-to-cost basis. To do this, we need to estimate the total costs that it is going to take to complete the contract.

We then compare this estimate of total costs to the amount of costs that have been incurred to date to measure the percentage of completion. The formula looks like this:

Costs incurred to date / most recent estimate of total costs = percent complete

3. Finding Revenue to Be Recognized to Date

We then combine our estimate for the total revenues (or in some cases gross profit) of the project with our estimate for the percentage of the project that has been completed to date to get the revenues to be recognized to date:

percent complete x estimated total revenue = revenue to be recognized to date

4. Finding Revenue to Be Recognized this Period

One we know how much revenue should be recognized to date, we subtract revenues that have been previously recognized to find the revenue that we should recognize in this period. We calculated total revenues to be recognized to date (and then subtract revenues previously recognized) so that adjustments for revenue recognition based on changing estimates of total revenues or total cost are recognized in the period that the estimates change.

Revenue to be recognized to date - revenue recognized in prior periods = current period revenue

Illustration of Percentage-of-Completion Method (Cost-to-Cost Basis)

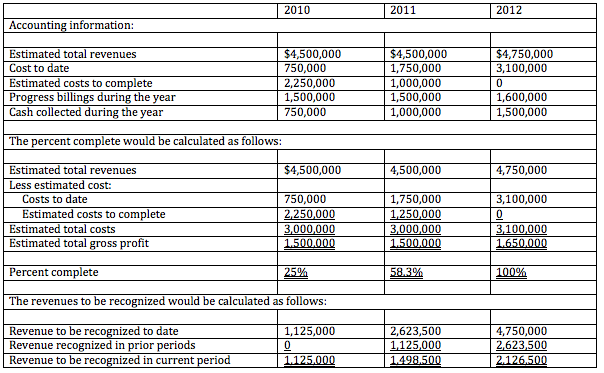

Here we've provided an example of schedule a contract manager might drawup for a contract in progress. The first section has the accounting information we need to calculate the information we need. The second section shows how we calculate our estimated percentage-of-completion. The third section shows how we use the estimated percentage-of-completion to calculate revenue to be recognized to date, revenue recognized in prior periods, and revenue to be recognized in the current period.

Journal Entries for Construction Project

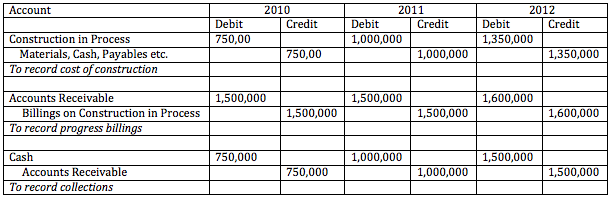

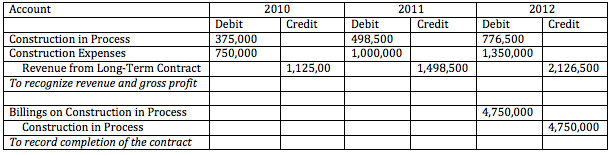

Based on the accounting information above, we would record the costs of construction, progress billings and collections as three seperate journal. We would then make two additional entries to rcognize revenue and gross profit.

You'll notice that in the first set of journal entries we add all of our payments to the inventory account construction in process. When we recognize our revenue and growth profit in the next set of hournal entries, we also add gross profit to construction in process. We close out the construction in process account only when we conclude the contract and send out the final invoice. Our total billings at this date should equal the amount in the construction in process account, which should equal all the costs incurred plus the gross profit on the contract.

Combining and Segmenting Projects

We refer to the contract in this case as an individual project, or 'profit center.' This means that a contract's revenues and costs are accounted for seperately, and investors can compare the rates of return on this project with other undertakings of the firm and the firm as a whole. Because this is the goal for accounting for a long-term contract as a 'profit center', U.S. GAAP recognizes that in some cases that it may be more useful if more than one contract were combined, and accounted for as one profit center. In opposite circumstances, one contract might encompass different undertakings that would be more accurately portrayed as seperate profit centers.

When to combine or seperate contracts for accounting requires considerabe judgement; the rules pertaining to which are outlined in FASB's codified accounting standards.3

References:

1. FASB ASC 605-35-25-1

2. FASB ASC 605-35-25-15

3. FASB ASC 605-35-25