Payback Period

The payback period provides information to managers about how much time it will take for a project or an investment to pay for itself. The payback period is the number of years that it takes for the sum of the cash flows from a project to equal the inital investment in the project. We can find the payback period by adding the cash inflows to the value of the initial investment (a negative number) until the number is position.

The payback period is easy to conceptualize; for example, if a new machine costs $10,000 and provides $5,000 of incremental profit a year, the payback period will be two years . A new machine that costs $10,000 and provides $500 dollars a year in incremental profits will take 20 year to pay for itself. Typically, therefore, a shorter payback period is preferable.

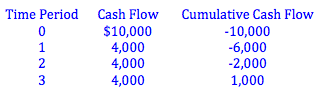

What if the initial investment is $10,000, and the project makes $4,000 a year? We estimate what fraction of a year should be added to the payback period to make $10,000 using the following formula.

Where,

A = the last period where the cumulative cash flows are still negative, that is, the sum of the cash inflows in the next year would be more than the amount of the initial investment

B = the remainder, ie. the net cumulative cash flows up until the end of period A

C = the value of the cash flows for the period after A

In our example, our total cumulative cash flows at the end of year 2 is $-2,000 (-$10,000 + $4,000 + $4,000), therefore, we still need $2,000 more to payback the initial investment. Since the cash flows in year three are expected to be $4,000, we estimate that it will take half of a year more ($2,000/$4,000) to payback the project. Therefore, the total payback period is 2.5 years.

Payback period = 2 years + $2,000/$4,000 = 2.5 years

Because of its ease-of-use, payback period is a common tool used to evaluate investments and communicate investment decisions in organizations. One major flaw in using payback period to evaluate and compare investments is that it does not take into account the time value of money. For example, consider the $10,000 new machine. What if one purchase option provides incremental profits of $4,000 in the first year, and another provides a $10,000 lump sum in 2.5 years? Both machines would have a payback period of 2.5 years; however, the first machine would clearly make you better off.

Discounted Payback Period

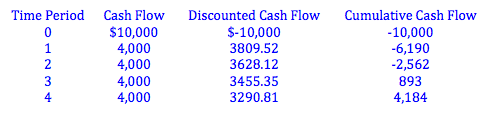

To solve this problem, financial managers often use a discounted payback period. This is found by first discounting each cash flow from the project, and then finding the cumulative discounted cash flows. Assume there was a 5% discount rate in the above example.

As you can see, by the third year the cumulative cash flows become positive. Therefore, the payback period must be two years plus some fraction of another year. This can be determined using the formula from above.

Payback period = 2 years + $2,562 / $4,000 = 2.64 years

There are also tools for calculated a modified payback period if subsequent cash flows for a project are not all positive.

Photo by Mika Baumeister on Unsplash

© BrainMass Inc. brainmass.com July 25, 2024, 2:32 pm ad1c9bdddf