Notes receivable are very similar to accounts receivable, with two main differences. The main difference between notes receivable and accounts receivable is that a note receivable is supported by a formal written instrument of credit as evidence of the debt (a promissory note). The note receivable will require the debtor to pay interest, will be collected in a time period greater than thirty days, and can legally and readily be sold or transfered to others. The second difference is that not all notes receivables are trade recievables; that is, not all notes receivables arise in the ordinary course of business. For example, a notes receivable might be made when a company lends money to an employee or a subsidiary.

Notes receivables alays require the debtor to pay interest. Interest bearing notes have a stated rate of interest that is payable in addition to the face value of the note. Zero-interest-bearing notes still require the debtor to pay interest, but this interest is imputed (as opposed to being stated explicitly): it is equal to the difference between the amount of borrowings and the stated face value of the note.

Interest-Bearing Notes

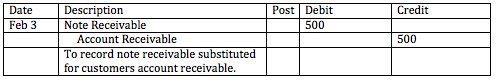

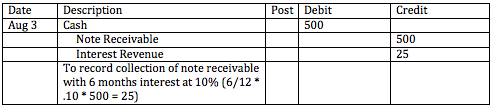

For example, a company may negotiate with a customer who is having difficulty paying an account payable by allowing the customer to substitute a six month note payable for their account receivable. Assuming the customer owes $500, and the interest rate is 10%, the journal entries would look like this:

Non-Interest-Bearing Note

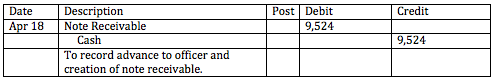

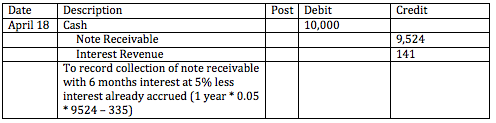

For a non-interest-bearing note, the amount of interest income is equal to the difference between what the borrower is obligated to pay in the future, and what they receive today. For example, an employee of a company may sign a $10,000 promissory note for one year from now. If the interest rate is 5%, instead of receiving $10,000 today, the officer would receive $9524 today ($10,000/1.05). The difference would be considered interest revenue, and would be accounted for when the officer pays the firm $10,000 in one years time.

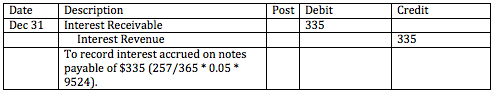

Above, we show how if the note is still outstanding at the date that year-end financial statements are prepared, we must make an adjusting entry to accrue the revenue earned from the note payable. This same rule applies regardless of whether or not the note payable is interest bearing or not.

Notes Receivable

BrainMass Categories within Notes Receivable

Long-Term Notes Receivable

The value of long-term notes receivable are measured and recognized on the balance sheet at the present value of the cash amounts that are expected to be collected from the notes receivable in the future, with the amounts discounted at the market rate of interest for loans with similar risk and other similar characteristics.

BrainMass Solutions Available for Instant Download

Interest-Bearing Note Receivable

Johnson Ltd completed the following transaction during 2014 and 2015. Prepare journal entries to record these transactions. 2014 October 14 Sold merchandise to Bruce Company, receiving a 60-day, 9% note for $10,000. November 16 Sold merchandise to Marine Company receiving a 72-day, 8% note for $9,100. December 13

Notes Receivable - Interest-Bearing Notes

Martin Manufacturing held three interest-bearing notes during 2014 and 2015. For each note, determine the following items. a. The maturity date b. The maturity value c. Interest revenue to be reported on December 31, 2014 Note 1 - issued September 25, 2014, $15,000, 10%, 60 days Note 2 - issued November 20, 2014, $2