Net Present Value (NPV) analysis is the most important tool for financial managers when making capital budgeting decisions. The ultimate goal of a financial manager is to make decisions that increase the value of the firm to shareholders. Imagine a project that costs $10,000 and makes a company $9,000; the project will lose $1,000, and it should be rejected. What if the same project immediately brings in $11,000? Accepting this project will increase the value of the firm. It is clear in these examples what type of projects should be accepted and what projects should be rejected.

However, what happens when a project costs $10,000 today, and provides $10,000 next year? We know because of the concept of time value of money you wouldn't invest $10,000 today to only receive $10,000 in the future. What if the project will bring in $10,500 next year? At what point does it make financial sense to accept the project?

A net present value analysis takes into account all of the cash flows associated with a project, both cash inflows and cash outflows. These cash flows are discounted using a required rate of return determined by the company as appropriate for the project. The discounted cash flows are added together to get a "net present value," that is, the sum of both the positive and negative cash flows discounted to present value.

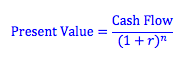

We use the present value formula to discount the cash inflows and outflows of the project.

Where, r = the discount rate

n = the time period that the cash flow occurs

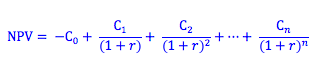

For a typical project, there is a cash outflow in the first period when the project is undertaken. Once the project is completed, the project will generate cash flows over its useful life. This suggests that the NPV of a typical project will look something like the following formula - we first subtract the initial investment, then add back the subsequent discounted cash inflows.

Where C0 = the initial cash investment (cash outflow)

C1 = the cash flow from the first period

Cn = the cash flow from the nth period

n = the last period in the life of the project

r = the interest rate

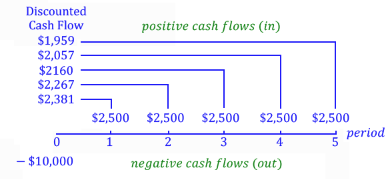

Let's look at our $10,000 example. Imagine that $10,000 is an investment in a new oven. The oven is going to make 1000 additional loafs of bread than its predecessor each year, which can each be sold for a profit of $2. There are no additional costs for running this oven, in fact, the new oven will save the company $500 dollars a year. The useful life of the oven is five years, with no salvage value. What is the net present value of the oven?

Each year the oven generates cash flows for the company of $2,500 ((1000 loafs x $2) + $500). We can look at the cash flows as follows, and discount them back to the present period using the present value formula (using a 5% discount rate for the oven). As we can see below, the net present value is positive; therefore, we should buy the oven.

Net Present Value = Sum of All Discounted Cash Flows = -10,000 + 1,959 + 2,057 + 2,160 + 2,267 + 2,381 = $823

Photo by Michelle Spollen on Unsplash

© BrainMass Inc. brainmass.com June 30, 2024, 8:12 am ad1c9bdddf