Logging, oil and gas, and mining are all natural resource industries. When natural resources are owned by a company, they are an asset. However, natural resources are not quite like inventory because they can't be produced (they can only be replaced by natural processes). This makes it conceptually difficult to cost natural resources the same way we cost inventory. On the other hand, natural resources are not quite like operating assets because their value is reduced when the natural resources are depleted. This makes it conceptually difficult to cost natural resources using depreciation, the way we typically expense operating assets. Thus we use a third approach for accounting for natural resources.

Initial Measurement

Under historical cost accounting, we need to know the cost of assets so that they can be amortized (matched) against revenues over their useful life. When we buy an operating asset, our cost-basis is usually the purchase price of the asset and costs associated with bringing it into use. We use this same approach for determining the cost-basis of natural resources when they are purchased. However, many companies undertake the exploration of new natural resources themselves. When natural resources are found and developed internally, we can use one of two methods for calculating the cost-basis: the succesful-efforts approach or the full-cost approach. Whether the natural resources are purchased or developed internally, in both cases the cost-basis should also include any future restoration costs (discounted to the present period).

Full-cost approach: This approach capitalizes all costs associated with discovering reserves, including the costs of unsuccesful exploration. The argument for this cost treatment is that the costs of succesful exploration necessarily includes the costs of unsuccesful exploration, since it's impossible to have one without the other.

Succesful-efforts approach: This approach capitalizes only those costs associated with succesful exploration and expenses the costs of unsuccesful exploration. The argument for this cost treatment is that, although costs associated with unsuccesful exploration are necessarily incurred when discovering reserves, it is hard regard a 'dry hole' as an asset.

Subsequent Measurement

When natural resources are extracted and sold, we say that the asset is being 'depleted'. Depletion is therefore the process by which we amortize (match) the historical cost of the natural resources to the periods of time in which it is used up. The depletable cost is equal to the cost-basis of the asset (measured above) less its salvage value (if any).

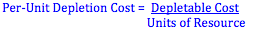

We can find a per-unit cost of depletion by dividing the depletable cost by the number of units of the resource (for example, if its an oil well we would need to estimate how many barrels of oil the well will produce).

Our depreciation for the period can then be found by multiplying the number of units extracted and sold during period by our per-unit depletion cost.

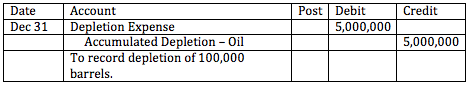

Recording the Expense

Depletion expense is recorded during the period as an operating expense. The expense is debited. The account credited can be either the capital asset account for the natural resource itself, or a contra-asset account for the accumulated depletion of the asset.

Natural Resources

BrainMass Solutions Available for Instant Download

Change in depletion estimate

In 2016, the Marion Company purchased land containing a mineral mine for $1,600,000. Additional costs of $600,000 were incurred to develop the mine. Geologists estimated that 400,000 tons of ore would be extracted. After the ore is removed, the land will have a resale value of $100,000. To aid in the extraction, Marion built var

Natural Cosmetic Ltd (NCL)

Natural Cosmetic Ltd (NCL) has used a conventional cost accounting system to apply quality control costs uniformly to all products at a rate if 16 per cent of direct labour cost. Monthly direct labour cost for Satin Sheen make-up is $98000. In attempt to distribute quality control costs more equitably, NCL is considering activi

Natural gas case: case study

Here is instruction. ? Read case 10-5, The Natural Gas Case, in International Business Law. Address the following: ? Summarize the facts of the case. o What is at risk for the seller, for the buyer, and in general? o What was the outcome? ? Provide an explanation of the issues in the case using international law.