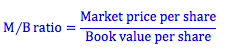

The market-to-book value ratio is calculated by dividing the market price per share by the book value per share. Because the book value of equity reflects its historical costs, this ratio gives us a sense of what the market value of the firm’s outstanding equity is relative to the initial cost of the equity – the amount that initial investors contributed as equity to finance the corporation.

A market-to-book ratio of less than 1 may suggest that the firm has not done a good job of creating value for its shareholders.

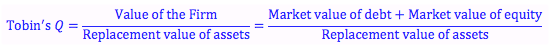

Tobin’s Q is similar to the M/B ratio. We find the Q value by dividing the market value of the firm (that is, the market value of the firm’s debt plus equity) by the replacement value of the firm’s assets.

The main difference between the M/B ratio and Tobin’s Q is that Tobin’s Q compares the total market value of the firm (not just the market value of equity) to the replacement value of assets (not the historical cost of equity). Firm’s like Coca-Cola typically have a high Q ratio because of its competitive advantage. Firm’s like National Steel and U.S. Steel have had Qs of less than one in the past suggesting they may not be the most attractive investment opportunity.