When more than one long-term assets are purchased together for a lump-sum price, we typically need to determine the historical cost for each individual asset. To do this, we tend to allocated the lump sum cost to the group of assets based on their relative fair values. To determine the fair value of each asset in the group, we might use a number of different sources. Asset appraisals for insurance purposes are one source. Appraisals for property taxes might be another. In other cases, we may simply hire an engineer or professional appraiser to provide their opinion on the fair value of the asset.

A common example of a lump sum purchase is when land is purchased along with the buildings on the land and the fixtures attached to the land and buildings, all for one lump sum price. Another example is when assets or a business unit are sold by one business in exchange for a number of shares.

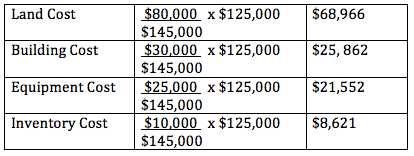

Consider a company that purchases several assets from another company in exchange for common shares of the their company with a fair value of $125,000 today. In exchange for these shares, the company received land (with a fair value of $80,000), a warehouse (with a fair value of $30,000), equipment (with a fair value of $25,000) and inventory (with a fair value of $10,000). The total fair value of the assets received is therefore equal to $145,000. We would calculate the historical cost for each asset by doing the following

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Accounting for Long-Term Assets

- /

- Property, Plant and Equipment

- /

- Capital Expenditures

- /

Lump Sum (or Basket) Purchases

BrainMass Solutions Available for Instant Download

Allocation to individual assets upon lump sum purchase

Alpha Company made a lump sum purchase of land, building, and equipment. The following were the appraised values of each element: PP&E Element Amount Land $10,000 Building 20,000 Equipment 30,000 Alpha paid $45,000 cash for the lump sum purchase. What value should be allocated to the following? (Enter only whole dolla