Interest Payable

Interest payable is a current liability that reports the amount of interest expense that has accrued over the period but has not yet come due or has not yet been paid.

The accrued interest expense is calculated at the balance sheet date. For example, imagine the company has $1,000,000 bank loan that charges 9% a year, due on the 8th day of each month. On December 31st, the business will have accrued this interest expense from December 9th until the end of the month. Even though this interest expense will not be payable until January 8th, the amount accrued should be reported as an expense on the current period's income statement as well as a current liabilitiy on the balance sheet.

The interest can be calculated by taking the number of days it has accrued, multiplying it by the daily interest rate, and multiplying the answer by the amount borrowed - in this case, $1,000,0000.

Days Interest Accrued = 31 - 8 = 23 days

Daily Interest Rate = 0.09/365 = 0.000246575

Accured Interest Expense (on balance sheet date) = 23 days x 0.000246575/day = $5,671.23

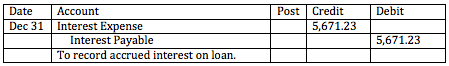

The journal entry above records the recognition of the accrued interest expense in the current period and the offsetting entry to increase interest payable.

Current Maturities of Long-Term Debt

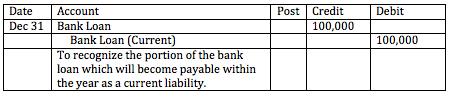

In addition to interest payable, principal amounts of bonds payable, mortgage payable, long-term notes payable, and other long-term indeptedness that will become due within twelve months of the balance sheet should be reported as a current liability to reflect the fact that these liabilities will require the use of current assets. As a result, if the liability will be settled using specified assets that have not been reported in current assets, the liability should not be reported as a current liability, even if it will be paid within the year.

Liabilities that are due on demand or that will be due on demand within the year (or operating cycle, whichever is longer) should also be reported as a current liability. Often liabilities become callable by creditors when a business violates a restrictive covenant on the debt. As a result, if there is a violation of the debt agreement the debt may need to be reclassified as a current liability.

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Accounting for Liabilities

- /

- Current Liabilities

- /