Long-lived assets that are held and used are not subject to the lower of cost and market rule that inventory is. Because inventory is intended to be converted to cash within a short period of time, it is important that their value on the balance sheet is no more than the amount of cash expected to be collected for their sale. Long-lived assets, on the other hand, get their value from being put to use by the firm, rather than from an expectation that they will be sold for cash. In the past, firms were able to change the carrying amount of long-lived assets over time. Today, accounting regulators are much more reluctant to allow firms to tinker with these values.

What is impairment?

Impairment is the condition that exists when the carrying amount of a long-lived asset (or asset group) exceeds its fair value.1 The carrying amount or net book value of a long lived asset is equal to the assets historical cost (or book value) less its accumulated depreciation.

Measuring impairment

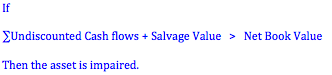

Step 1: The recoverability test. The test for determining if impairment should be recognized is often referred to as the “recoverability test.” Under the recoverability test, we say that the carrying amount of a long-lived asset is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the asset. If the carrying amount of an asset is not recoverable, the asset is impaired.

Step 2: Measuring impairment. Although we use the recoverability test to determine if an asset should be recognized as impaired, we measure impairment differently. According to GAAP, an impairment loss should be measured as the amount by which the carrying amount of a long-lived asset exceeds its fair value.2

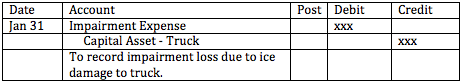

Step 3: Recording the impairment loss. The impairment loss is an expense and either reduces the capital asset account or increases the accumulated amortization account. Both methods may be used. The benefit of crediting accumulated amortization is that the historical cost of the asset is perserved on the books. The benefit of crediting the capital asset account is that this amount can be used as the new cost-basis for straight-line or units of activity depreciation (for declining balance, it wouldn't matter what account was credited). In either case the depreciation method, the useful life and the salvage value of the asset should be reviewed after an impairment loss is recognized.

Note: Long-lived assets that are held-for-sale are subject to the lower of book and net realizable value rule. As a result, the recoverability rule does not apply. Losses are always recognized when the book value of an asset that is held-for sale is believed to be less than its net realizable value from a sale in the near future. Similarly, gains can be recognized when it is believed that the asset's net realizable value has increased, as long as these gains do not increase the value of the asset beyond its original book value when it was reclassified as held-for-sale.

References:

1. FASB ASC Glossary

2. FASB ASC 360-10-35-17

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Accounting for Long-Term Assets

- /

- Property, Plant and Equipment

- /