In the ordinary course of business, most companies derecognize their accounts and notes receivables when they are collected. However, asset-based financing allows companies to use their assets, such as accounts receivable, to generate immediate cash for this business. This can be done in two ways:

1. Secured borrowing: A company borrows money from a financing company (such as a bank) and uses its accounts receivable as colleteral for the borrowing. When the accounts are collected, they must use the proceeds to repay their borrowings.

2. Sales of receivable: Companies can sell their accounts receivables to a factor, that is, a company that buys receivables from businesses for a fee and then collects the amounts owed directly from the customer. Receivables can also be securitized, which transforms the assets into securities that are backed by the pool of assets and offer interest and principal payments. These are called asset-backed securities.

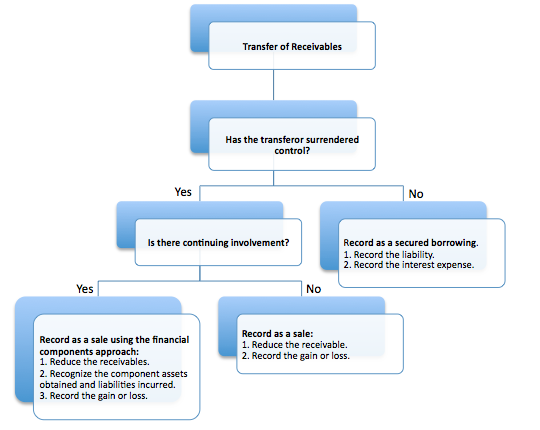

According to U.S. GAAP, a company cannot account for the transfer of a financial asset or a participating interest in a financial asset as partially a sale and partially a secured borrowing.1 This gives us two choices: is the transfer of a receivable a sale, or a secured borrowing? Furthermore, if it is a sale, there is one more question we must ask: is the sale one with continuing involvement, or a sale without? These decisions that accountants must make are summarized in the following diagram.

Criteria for Treatment as a Sale

According to the FASB, three criteria must be met for the transfer of financial assets, including accounts receivable, to be accounted for as a sale.2

1. The transferred financial asset must be isolated from the transferor. For example, it presumptively must be beyond the reach of the transferor and its creditors, even in bankruptcy or other receivorship.

2. The transferee receives the rights to pledge or exchange the financial assets, and the transferor looses these rights. This implies that two conditions must be met: (a) the transferee must gain the right to pledge or exchange the financial assets (or beneficial interest in the assets); and (b) no condition does both of the following: (i) constrains the transferee from taking advantage of this right and (ii) provides more than a trivial benefit to the transferor.

3. The transferor (and its consolidated affiliates) lose effective control over the assets. For example, effective control would not be lost if there exists an agreement that obligates the transferor to repurchase the assets before their maturity, an agreement that allows the transferee to require the transferor repurchase the assets at a price so favourable to the transferee that they are certain to exercise it, or an agreement that allows the transferor to unilaterally require that the transferee return the assets with a more than trivial benefit to the transferor.

Criteria for Continuing Involvement

If receivables are sold with recourse, the transferor gaurantees payment to the purchaser if the cutomer fails to pay. A financial components approach is used to recognize this transfer. That is, the transferor and the transferee will recognize the components (assets and liabilities) they have control over after the transfer is complete.

No Continuing Involvement

When there is no continuing involvement, we say that this is a sale without recourse. In this case, the transferee accepts the risk of collection and absorbs any credit losses.

References:

1. FASB ASC 860-10-40A

2. FASB ASC 860-40-10

Factoring Accounts Receivables

BrainMass Solutions Available for Instant Download

Financial Sheet Analysis of Trade and Other Receivables

Attached are two companies' annual reports. Please look through these two annual reports and discuss the key components and features of trade and other receivables.