In the United States, the federal government and most states levy corporate income taxes. A company's federal taxable income is calculated based on the rules in the Internal Revenue Code. Taxable income in the state level is often determined by reference to the federal taxable income as well. On the other hand, accounting income (or income before taxes) is calculated using GAAP. This means that income for financial reporting purposes is often different then the income for tax purposes. The difference results from differences between GAAP and tax rules. When an item is included in accounting income but will not be taxed until a later period, it makes sense that the amount of the unavoidable future tax liability should be recognized on the balance sheet today.

A deferred tax liability is therefore the amount of future tax that will be payable on items that are recognized on the balance sheet today. The liability signals to financial statement users that the company's accounting income in the future will be less than its taxable income, and thus the future tax expense is going to be higher than would otherwise be expected.

The difference between taxable income and accounting income typically arises because GAAP is accrual-based and taxable income is cash-based. For example, revenues from a sale to a customer on account are recognized under accounting income today; however, under taxable income the revenues would not be recognized until the account receivable is actually collected. Another major difference arises when the capital cost allowance for taxable income differs from the amount of depreciation the company recognizes under GAAP. Depending on the method of depreciation chosen, often the cost is deducted faster for tax purposes than for financial reporting purposes. As a result, less of the expense will be deducted from taxable income in the future than will be deducted from accounting income. This means that future taxable income will be higher than accounting income and a liability should be recognized that represents the tax that will be owed because of this difference (see Tax Basis of an Asset).

Example:

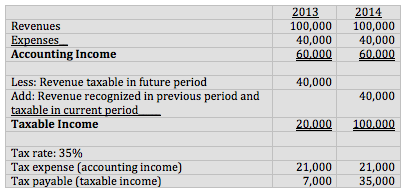

A corporation makes sales this year on account for $100,000. Revenue is reported in accounting income for $100,000. The accounts receivable will be collected $60,000 this year and $40,000 Expenses are $40,000 for both years. The tax rate is 35%.

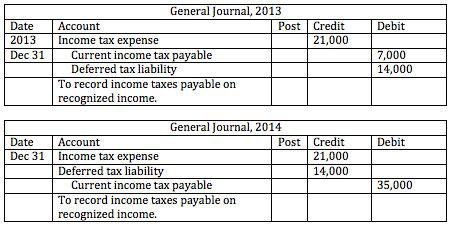

In the current period we would recognize an income tax expense of $21,000, current income tax payable of $7,000 and a deferred tax liability of $14,000. Next year we would recognize an income tax expense of $21,000, current income tax payable of $35,000 and remove the deferred tax liability. This ensures that our accounting income is reconciled with our taxable income for financial reporting.

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Accounting for Corporations

- /

- Accounting for Corporate Income Tax

- /

Deferred Income Taxes

BrainMass Categories within Deferred Income Taxes

Tax Basis of an Asset

Solutions: 4

The tax basis of an asset is the amount related to the asset that the Internal Revenue Code allows to be deducted from any revenues generated by the sale or use of the asset for income tax purposes. If an asset has no tax consequences, its tax basis will equal its carrying amount.

Tax Basis of a Liability

Solutions: 2

The tax basis of a liability is the related amount that reduces the expense that is expected to be deducted from taxable income. If a liability has no tax consequences, its tax basis will equal its carrying amount.