We look to find accounting mistakes we might have made after preparing the trial balance. Most importantly, if the debits in our trial balance do not match our credits, we've probably either made a mistake preparing the trial balance, or we've made a mistake somewhere in our general journal or in posting to the ledger. Not all mistakes will make the trial balance out-of-balance, and it's good if we can find and correct these mistakes too - but that's a lot more work than the first approach.

Finding mistakes when the trial balance is out-of-balance:

1. Re-add all of the columns in your trial balance. It may simply be a math error. Similarly, if your trial balance is off by a number such as 10, 100, or 1000, it is most likely a math error. Double check that you added correctly and that you copied in all the right numbers.

2. Did you omit an account, or put the accounts balance in the wrong column when preparing the trial balance? If you did, this will make the trial balance off by twice the amount of the error. Divide the out-of-balance amount by two and look for an account on your trial balance with that amount.

3. Did you make a transposition error (write $2100 as $1200) or a slide error (write $2100 as $210) when preparing the trial balance? If the out-of-balance number is divisible by 9, it is likely one of these two types of errors. Double check the trial balance for accounts with similar numbers.

4. Is there an error in the general journal or a posting error (was a transaction not posted correctly) in the ledger accounts? You might have to go back and look at your records and follow them through the journal and ledger to find the error. Look for records of transactions with similar amounts to the amounts discussed above.

When the error is found because of an out-of-balance trial balance, we open what is called a suspense account. The suspense account will be the same as the out-of-balance amount of the trial balance. When the error is found, and corrected, it is cancelled out with the suspense account.

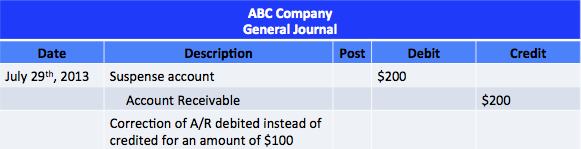

For example, a mistake could be made where accounts receivable was accidentally debited by $100 instead of credited. The out-of-balance amount of the trial balance would be $200. We would make a temporary suspense account for $200, and a correcting entry as follows:

Finding mistakes that won't make the trial balance out-of-balance:

1. Error of Ommission: An entire transaction is missed. There will be no debit, or credit entered.

2. Error of Commission: A double entry is made, but one entry is journalized or posted to the wrong personal account (for example, when receiving payment from a client, recording it to another client's account.

3. Error of Principle: Recording an entry to the wrong classification of account, such as capitalizing an expense.

4. Compensating Errors: When two or more errors accidentally cancel eachother out.

5. Error of Original Entry: The number used to enter the original transaction is wrong, both for the debit amount and equally for the credit amount. This may include transposition or slide errors.

6. Reversal: The accounts to be debited and credited may get switched.

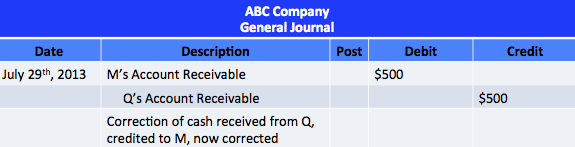

If the error is made in the general journal and/or the ledger, we may have to do a correcting journal entry and post it to the correct accounts. Don't worry, this is easy. For example, imagine ABC.co received a payment from one of its customers, Q, for $500 cash. However, the bookkeeper accidentaly credits it to M's account. Now it looks like M paid $500, not Q. We do a simple correcting entry with the following note:

Correcting Accounting Errors

BrainMass Solutions Available for Instant Download

Analysis of Inventory Errors

Abco Company had $1,100, 000 of sales in each of three consecutive years 2008-2010, and it purchased merchandise costing $700,000 in each of those years. It also maintained a $280,000 physical inventory from the beginning to the end of that 3 year period. In accounting for inventory, it made an error at the end of year 2008 that

Inventory costing methods and comparative income statements

See attachment for table. Shown below are net income amounts as they would be determined by Weihrich Steel Company by each of three different inventory costing methods ($ in 000s). 1. Assume that Weihrich used FIFO before 2016, and then in 2016 decided to switch to average cost. Prepare the journal entry to record the chan

Garner: Inventory method; basic diluted EPS; convertible bonds

Garner Company began operations on January 1, 2015, and uses the average cost method of pricing inventory. Management is contemplating a change in inventory methods for 2018. The following information is available for the years 2015-2017. (See attached file) On January 1, 2017, Garner issued 10-year, $200,000 face value, 6

Merchandise Inventory - Calculating Cost of Goods Sold

MERC HANDISE INVENTORY Chinger Company sells three products. The following information is available for the three products. P Q R Beginning inventory $15,000 $27,000 $15,000 Purchases 45,000 65,000 62,000 Goods available for sale

How Accounting Errors Occur

How do accounting errors occur? What are examples of errors you have encountered at your place of employment (if you are aware of any)? Why is it necessary to correct them? What are the ramifications of not correcting errors?

Effect of Changes due to Accounting Errors for accrued salaries and supply expense

Accrued salaries payable of $51,000 were not recorded at December 31, 2010. Office supplies on hand of $24,000 at December 31, 2011 were erroneously treated as expense instead of supplies inventory. Neither of these errors was discovered nor corrected. The effect of these two errors would cause A- 2011 net income to be unders

Accounting

What is the difference between accounting changes and accounting errors? What are some similarities and differences in how they affect the financial statements?

Accounting for Changes and Errors - Berkley Company

Can you help me get started on this assignment? Berkley Company, a manufacturer of many different products, changed its inventory method from FIFO to LIFO. The LIFO method was determined to be preferable. In addition, Berkley changed the residual values used in computing depreciation for its office equipment. It made this cha

Counterbalancing errors, correcting errors and other accounting questions

Can you help me get started with this assignment? What are some examples of counterbalancing errors? What are some examples of non-counterbalancing errors? What are the differences between counterbalancing and non-counterbalancing errors? How are each handled? Does it matter if the books are closed? Why or why not? Why do

Accounting Errors

36. Accrued salaries payable of $51,000 were not recorded at December 31, 2007. Office supplies on hand of $24,000 at December 31, 2008 were erroneously treated as expense instead of supplies inventory. Neither of these errors was discovered nor corrected. The effect of these two errors would cause. A) 2008 net income to be

Accounting errors corrected prior to closing the books

Linda Company's auditor discovered two errors. No errors were corrected during 2005. The errors are described as follows: - Journal entries (a) Merchandise costing $4,000 was sold to a customer for $9,000 on December 31, 2005, but it was recorded as a sale on January 2, 2006. The merchandise was properly excluded from the 2

What is the total effect of the errors on 2005 net income?

Rodney Company's December 31 year-end financial statements contained the following errors: December 31 , 2004 December 31 , 2005 Ending inventory, $4,000 understated Depreciation expense, $800 understated December 31 , 2005 Ending inventory, $3,600 overstated An insurance premium of $3,600 was prepaid in 2004 covering

Accounting Errors

A company uses both special journals and a general journal. The company accountant made the following errors during July. 1. Incorrectly added the credit entries in a customer's account in the accounts receivable subsidiary ledger. The total was listed as $2,690; it should have been $2,790. 2. A remittance of $400 from Do