Dividends are typically paid in the form of cash, however, may be paid in other forms such as in shares or other assets. When a corporation pays dividends in the form of cash (or other assets - but not stock) the shareholders' equity of the firm decreases.

Declaration date: This is the date that the dividend is authorized to be paid to shareholders by the board of directors. A journal entry is made on this date to show that a dividend has become payable and to reduce retained earnings.

Date of record: All the shareholders who own shares and are listed on the share register on this date will receive the declared dividend. There is no journal entry on the date of entry for the corporation. Because it may take up to two business days for the sale of shares to be registered, the important date from the perspective of the buyer is the ex-dividend date, which is typically 1 -3 days before the record date. A buyer who purchases the shares after this date will not be entitled to receive the dividend.

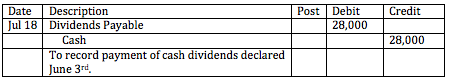

Date of payment: The date that the dividend is payable on. A journal entry is made on this date to show that cash is paid to shareholders and the dividend payable account is reduced.