Long-term bonds are the most common source of debt financing available to large corporations. Bonds are created by a contract known as a bond indenture and represent a long-term obligation to repay both a principal amount at a future date as well as to make interest payments. The main purpose of bonds is to raise long-term financing when the amount of capital that needs to be borrowed is too large for one lender to supply. By dividing the amount of capital to be raised into denominations, commonly $1,000, a large amount of capital can be raised from a number of different lenders who purchase only a portion, or unit, of the total debt.

Types of Bonds

The following are some of the many different types of long-term debt that are available to interested investors.

Term, Serial, Perpetual, and Callable Bonds: Debt that matures on a single date are called term bonds. Debt that matures in installments is called a serial bond. Perpetual bonds are bonds that have unusually long terms, such as 100 years. Callable bonds give the issuer the right to retire the bonds before they mature.

Registered and Bearer (Coupon) Bonds: Bonds that are issued in the name of a specific owner are called registered bonds. Holders of registered bonds automatically receive interest payments. A bearer or coupon bond is not registered in the owners name and can be transferred. These bonds require the owner to present the bond to redeem the coupon for the interest payment owed. Whoever presents the bond (not just the owner) can receive the interest payment.

Secured and Debentures (Unsecured Bonds): Bonds are secured when specific company assets are pledged to serve as collateral for the debt. Sinking fund bonds require the issuer to set aside a pool of assets used jointly to repay the bonds at maturity. Bonds that are not backed by collateral are more risky, and are call debentures or unsecured bonds.

Convertible Bonds: Convertible bonds can be exchanged for a fixed number of shares of the compnay's stock. Comodity-backed bonds are convertible for a fixed amount of a commodity, such as barrels of oil.

Bond Ratings

The price of a bond is based on the market's assessment of the company's ability to pay amounts due on a specific date. A credit rating is assigned to each new issue of bonds, and there are many companies that assess credit ratings of company bonds and preferred shares. These companies include Moody's Investors Service, Fitch, Standard & Poor's Corporation, and Dominion Bond Rating Service (DBRS).

Bond Pricing

When a note or bond is issued, it should be recognized at the fair value of the consideration that is received.

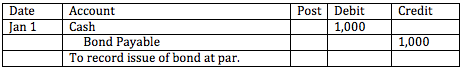

Bonds issued at par: When a bond is issued at par, ie. the stated interest rate on the bond and the market rate are the same, no interest has accrued and there is no premium or discount. The accounting entry is made simply for the cash proceeds and the bond's face value.

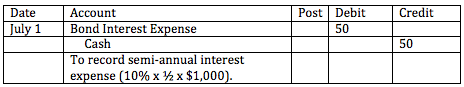

When the coupon rate is the same as the market rate of interest, the interest expense for the period can be recorded simply.

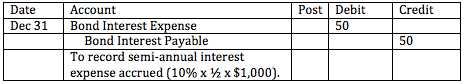

On December 31st, the accrued interest expense can be recorded simply as well.

Bonds issued at a premium or discount: The investment community values bonds based on the present value of their future cash flows, which vary depending on the applicable market interest rate, the coupon payments of the bond, and the principal. As a result, bonds may be sold at a discount or a premium. A bond is sold at a discount when the market rate of interest is higher than the stated rate on the bond, and the fair value of the bond is less than its face value. A bond is sold at a premium when the market rate of interest is lower than the stated rate on the bond, and as a result the bond can be sold for more than its face value. The reason that the face value of the bond changes when the market rate is different than the stated rate on the bond is because investors want to earn an effective rate of interest on the bond that is equal to the market rate. Because they cannot change the stated rate of interest, investors will pay less for a bond that offers them less interest than the market rate and more for a bond that offers them more interest than the market rate. The change in the fair value of the bond will be equal to an amount necessary to make the effective rate of interest that the investor earns equal to the market rate.

There are two methods used for accounting for bonds that are issued at a discount or a premium: the straight line method or the effective interest method.

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Accounting for Liabilities

- /

- Long-Term Financial Liabilities

- /

Bonds Payable

BrainMass Solutions Available for Instant Download

Entries and Questions for Bond Transactions

On June 30, 2014, Mischa Auer Company issued $4,000,000 face value of 13%, 20-year bonds at $4,300,920, a yield of 12%. Auer uses the effective-interest method to amortize bond premium or discount. The bonds pay semiannual interest on June 30 and December 31. Instructions (Round answers to the nearest cent) (a) Prepare the j

Early extinguishment of debt

The long-term liability section of Twin Digital Corporation's balance sheet as of December 31, 2015, included 12% bonds having a face amount of $20 million and a remaining discount of $1 million. Disclosure notes indicate the bonds were issued to yield 14%. Interest expense is recorded at the effective interest rate and paid

Debt Amortization Schedule

Prepare a debt amortization schedule for a bond issued at discount. Assume that the bond matures in 12 years with market interest rate at time of issue—10% annually and 5% semiannually. The stated interest rate is 8%. The interest is paid semiannually.

Partial Balance Sheet, Ratios and Loss Contingency

See attached file for Problem 10.7. The following items were taken from accounting records of Minnesota Satellite telephone corporation (MinnSat) for the year ended December 31, 2009 (dollar amounts are in thousands): MINNESOTA SATELLITE TELEPHONE CORPORATION Accounts payable $65,600 Accrued expenses payable (oth

Define source of account payable; price of bonds; effect to AP; current maturities

An accounts payable could result from - the purchase of accounts for cash? purchase property, plant and equip on credit? purchase goods and services from suppliers on credit? When bonds are issued at a premium are the bonds sold for less than their face amount? interest expense on the bonds will be more than the interest paid

Comprehensive Bond Accounting Problems

"In each of the following independent cases the company closes its books on December 31. For the two cases prepare all of the relevant journal entries from the time of sale until the date indicated. Use the effective interest method for discount and premium amortization (construct amortization tables where applicable). Amortize

Bonds Payable and Semi-Annual Interest Installments

See attached file please. Bonds Payable Based on the information below, prepare the journal entries for the following: (1) Issue of the bonds on January 1st. (2) Payment of the first semi-annual interest installment with cash. (3) Accrual of the second interest installment on December 31st to be paid on January 1st. Face

Bond Issuance and Calculation

Straight-line amortization of both bond discount and bond premium P1 P2 P3 Heathrow issues $2,000,000 of 6%, 15-year bonds dated January 1, 2004, that pay interest semiannually on June 30 and December 31. The bonds are issued at a price of $1,728,224. Required 1. Prepare the January 1, 2004, journal entry to record the bon

Recording and reporting a bond discount over two cycles: Semiannual interest

During 2008 and 2009, Jamie Co. completed the following transactions relating to its bond issue. The company's fiscal year ends on December 31. 2008 Mar. 1: Issued $ 100,000 of eight-year, 7 percent bonds for $96,000. The semiannual cash payment for interest is due on March 1 and September 1, beginning September 2008. Se

Journal Entries - Bonds

Heathrow issues $2,000,000 of 6%, 15-year bonds dated January 1, 2004, that pay interest semiannually on June 30 and December 31. The bonds are issued at a price of $1,728,224. Required 1. Prepare the January 1, 2004, journal entry to record the bonds' issuance. 2. For each semiannual period, compute (a) the cash payment,

Bonds Payable Problem

Please help with the following problem. Company issues $200,000 of 8%, 10-year bonds on January 1, 2006, at 103. Interest is payable semiannually on July 1 and January 1. The company uses the straight-line method of amortization a.) Journalize the entries for the bonds on (1) January 1, 2006, (2) July 1, 2006, and (3) Dec

On August 1, Stuart Co. issued $1,300,000 of 20-year, 9% bonds, dated August 1, for $1,225,000. Interest is payable semiannually on February 1 and August 1. Present the entries to record the following transactions for the current year:

Question 18: On August 1, Stuart Co. issued $1,300,000 of 20-year, 9% bonds, dated August 1, for $1,225,000. Interest is payable semiannually on February 1 and August 1. Present the entries to record the following transactions for the current year: (a) Issuance of the bonds. (b) Accrual of interest and amortizat

Determining the Bonds Payable

Kaye Co. issue $1 million face amount of 11% 20-year bonds in April 1,2004. The bonds pay interest on an annual basis on March 31 each year. Required: a. Assume that market interest rates were slightly lower than 11% when the bonds were sold. Would the proceeds from the bond issue have been more than, less than, or equal