Bank indebtedness for operating purposes is a major component of most company's current cash position. This is because it is easier to have an agreement with a bank for a line of credit or revolving credit facility instead of having to negotiate a new loan every time short-term financing is needed. Like a credit card, when the liability is paid down the business will be able to re-borrow under the same contract up to a certain limit. In addition to interest charged on amounts borrowed, the bank will typically charge a user fee.

Under these types of arrangements, the bank or loan institution usually requires certain assets to be put up as collateral for the short-term credit. Similarly, restrictive covenants may also be placed on the company's financials.

Short-term credit facilities are reporting on the financial statement as a current liability. User fees and interest charges are reported as operating expenses. The credit limit, restrictive covenants and assets held in collateral for the debt are disclosed in the notes to the financial statements.

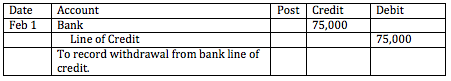

When the business borrows cash on a line of credit the bank account is debited (increased) and the line of credit liability is debited (increased).

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Accounting for Liabilities

- /

- Current Liabilities

- /

Bank Indebtedness

BrainMass Solutions Available for Instant Download

Bonds (Working Capital)

ABC Corporation, a household plastic product manufacturer, borrowed $14 million cash on October 1, 2016, to provide working capital for year-end production. ABC issued a four-month, 12% promissory note to XYZ Bank under a prearranged short-term line of credit. Interest on the note was payable at maturity. Each firm's fiscal peri