Accrued expenses are obligations that a company has incurred but have not yet become due. Interest payable and rent and royalties payable are examples of accrued expenses. Accrued expenses are important to report on the financial statement date in order to ensure that the expenses are reported in the period that they are incurred and the fair value of the liability is shown on the balance sheet as a short-term demand on current assets.

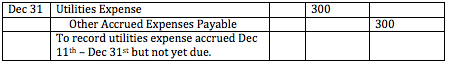

For example, a company may be billed for its utilities on the 11th day of each month. If the balance sheet date is December 31st, 20 days of utilities expenses will have been accrued (or used) by the company even though they will not be payable until the next month. A journal entry will be made to record the accrued expense and the corresponding liability.

When the accrued expense is something like utilities, it may need to be estimated on the balance sheet date. For other accrued expenses like interest payable or rent or royalties payable the accountant may be able to calculate the exact amount of the expense accrued.

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Accounting for Liabilities

- /

- Current Liabilities

- /