Rent expenses may arise from a contractual agreement to remit a proportion of sales revenue or profits. For example, many retail leases require a flat per-square-foot lease rate as well as additional charges based on the amount of merchandise a retailer sells. Similarly, royalty expenses may arise from a contractual agreement to pay a fee based on the quantity of a product produced that uses leased intellectual property. For example, a publisher may pay a royalty fee to the copyright holder for each book produced.

In both these cases the amount of the rent or royalty payable is conditional on the amount of revenue that is earned or the quantity of a product that is produced. As a result, for each additional dollar of revenue that is earned, or for each additional product that is produced, a liability account must be increased by the amount that will be payable. This ensures that the rent or royalty expense is recognized in the same period it was incurred.

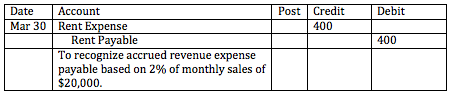

For example, a company that pays 2% of revenue in rent would make the following entry if it sold $20,000 worth of merchandise.

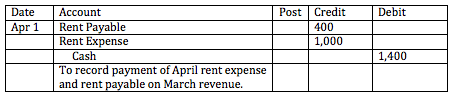

When the company pays its rent expense, the cash or bank account would be reduced and the liability would be reduced accordingly.

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Accounting for Liabilities

- /

- Current Liabilities

- /