Because of the special privileges associated with operating a business using a corporate structure, corporations are required to pay income taxes to the government on their annual profits. (Income earned by proprietorships and partnerships is taxed as the proprietor or partners’ individual income rather than as income from a separate legal entity.) Corporate income for tax purposes (based on the Internal Revenue Code) differs in some ways from income for accounting purposes (based on GAAP). This difference results in special income statement and balance sheet considerations.

Income Statement

Adjustments must be made to the income statement when calculating taxable income. Income statement adjustments are the first important consideration for income tax accounting.

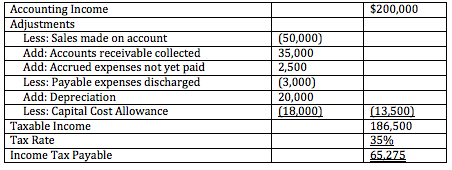

When calculating taxable income, most corporations begin with their accounting income and make adjustments for temporary and permanent differences.

Temporary Differences: Taxable income is usually calculated on a cash-basis, rather than an accrual basis. This means that revenue is only included when it is received as cash and expenses are only included when they are paid out. This leads to a temporary difference that must be reversed in later periods when cash is collected or expenses are paid.

Permanent Differences: Permanent differences result from items that are included in taxable income but never in accounting income, or vica versa, or are included by different amounts. For example, the revenue code requires its own unique calculations for depreciation, called capital cost allowance (CCA). This mean that most corporations much add back their depreciation expense (based on GAAP) to their accounting income and then deduct the required capital cost allowance in their calculations for taxable income. This difference will not be reversed in future periods.

Balance Sheet

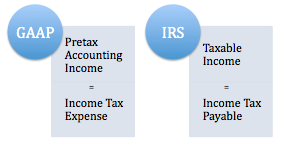

There is also a second consideration or part to income tax accounting that affects the balance sheet. GAAP requires corporations to recognize (or estimate) their income tax expense based on the items recognized in the financial statements. Because different items and different values may be recognized for accounting and tax purposes, this means that the income tax expense that GAAP requires to be recognized often differs from the corporation’s actually income tax payable. GAAP requires that the difference between the two amounts be recognized as either a future tax asset or a future tax liability on the balance sheet. This topic is discussed in more detail in "Deferred Income Taxes," "Tax Basis of an Asset" and "Tax Basis of a Liability".

Accounting for Corporate Income Tax

BrainMass Categories within Accounting for Corporate Income Tax

Deferred Income Taxes

Solutions: 6