Warrants are like options in that they give the holder the right but not the obligation to purchase an underlying asset. In this case, warrants give their holders the right to purchase a fixed number of shares of common stock directly from the issuing company at a fixed exercise price up until the expiry date. Other than typically a longer maturity date, there are not many differences between warrants and options.

Warrants are often described as "equity kickers" because they are frequently attached to privately placed bonds or preferred stock. Including warrants with the issue of other securities makes these securities more attractive. These extra perks allow the issuing company to pay less interest or less dividends. Warrants may also be used in private equity deals such as with privately placed bonds. In most cases, warrants attached to bonds or preferred stock are detacheable, and can be exercised or traded independently.

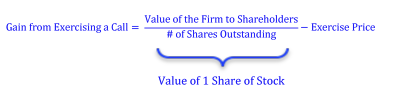

The most important difference between warrants and call options is that when a warrant is exercised the issuing firm must issue new shares. As a result, each time a warrant is exercised the number of shares outstanding increases. This dilution effect has an impact on the value of the warrant, something call options avoid. We can compare the gains from exercising a call and a warrant in more general terms:

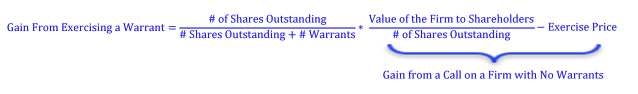

The following formula is generalized from the equation valuing the gain of the call. We recognize the value of one share of stock after a warrant is exercised is related to the value of the firm net of debt after the warrant is exercised. We find this value by adding the exercise price of the warrant (the amount the holder of the warrant will pay to the issuing firm to) the the existing value of the firm net of debt.

We know of several models that allow us to value options such as calls and puts. What we want to know is if there is a way to use these same models, for example, the Black-Scholes model, to value a warrant? The formula below is rearranged from above and relates the gain on a warrant to the gain on the call.

Looking at the above formula, we notice the gain on a warrant is equal to the gain on an identical call, adjusted by the factor #S/(#S + #W). This factor is the proportion or ratio of the number of shares in the firm without warrants to the number of shares after all the warrants have been exercised (that is, the number of outstanding shares + the number of warrants that will be exercised). We can then use the Black-Scholes Model to value the warrant, and adjust our solution by this factor. Note: The Black-Scholes model will give us the value of one call option; therefore, by using the adjusting factor, we still get the value of one warrant - even though we must account for the total number of warrants exercised.

Photo by Alvaro Reyes on Unsplash

© BrainMass Inc. brainmass.com April 19, 2024, 10:10 am ad1c9bdddf