When we look at a company's balance sheet over two periods, we can see if our company's cash balance increased or decreased. However, the balance sheet doesn't provide all of the information we need to know why our cash changed. The income statement reports revenues and expenses and provides some more clues to why cash changes. However, the income statement does not tell us everything we need to know about our company's change in cash. We'd like to have more information about how a firm generates its cash and its ability to pay its bills.

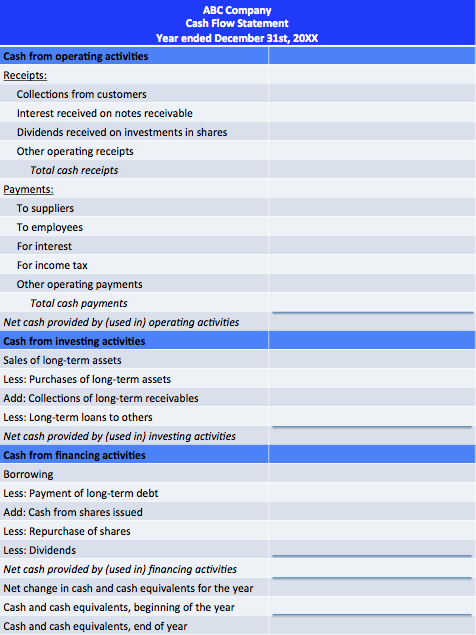

As a result, company's are required to report a fourth statement: the cash flow statement. Under International Accounting Standard (IAS) 7, cash flow statements are required to make sense of changes in cash and cash equivalents.The U.S. FASB Statement No. 95 (FAS 95) mandates that firms provide a cash flow statement as well; however, it gives each firm the latitude to determine what assets are to be classified as cash equivalents. Both of these standards requrie that companies report cash flows provided by (or used in) three categories of activities: operating activities, investing activities and financing activities. Cash flows from these three activities are netted in order to get the net change in cash over the period.

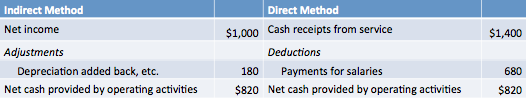

There are two methods that can be used to build a cash flow statement. The direct method is easier to understand, as it simply lists cash receipts and cash payments for the year in each category. The indirect method (or reconciliation method) looks to reconciles net income with net cash provided by operations by making adjustments for deferrals, accruals and other items that affect net income but not cash.

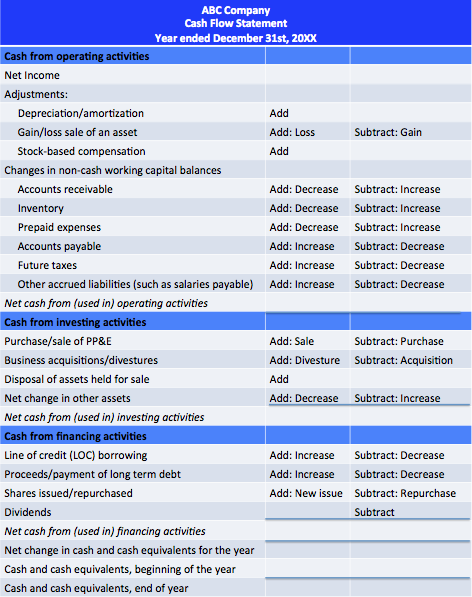

The Indirect Method

With the indirect method, we start with a firm's net income figure from the income statement and adjust this figure for (a) all deferrals of past operating cash receipts and payments and all accruals of expected future operatin cash receipts and payments and (b) all items included in net income that do not affect operating cash receipts and payments. In this way we reconcile the income statement with the enterprises cash flow from operations. We can then use the direct method for investing and financing activities.

FAS 95 requires that companies that use the direct method provide a supplementary statement similar to the indirect method cash flow statement; as a result, the indirect method is most commonly used.

Items that are typically added back to net income to get cash flow from operations include:

- Depreciation (loss of tangible assets' value over time)

- Deferred tax

- Amortization (loss of intangible assets' value over time)

- Any gains or losses associated with the sale of non-current assets, dividends received, and revenue from investing activities (we exclude these from the operating section and include them in the investing section of the cash flow statement)

The Direct Method

Operating activities: A business's ordinary operations typically include buying and selling goods and services to customers, and this section of the statement of cash flows shows the cash provided or used in these activities. Cash from operating activities is a business's most important source of cash. Continually negative cash from operating activities can lead to bankruptcy.

Cash inflows from operating activities are:

- Cash receipts from sales of goods or services, including from lessees, lincensees and the like

- Cash receipts from interest and dividends received

- All other cash receipts that do not stem from investing or financing activities (such as lawsuits, insurance claims and refunds)

Cash outflows from operating activities are:

- Cash payments for goods, materials, and inventory as well as accounts payable and notes payable for the same

- Cash payments to other suppliers and employees for goods or services

- Cash payments for taxes

- Cash payments for interest

- All other cash payments that do not stem from investing or financing activities (such as settling a lawsuit, donating to a charity or cash refunds)

Investing activities: Investing activities include the purchase of productive assets that a company will use in the production of goods and services. By extension, the disposal of these assets is considered an investing activity. Other assets such as making loans to other businesses or buying a stake in another company are also included as an investing activity. Typically net cash from investing activities should be negative - we want to see that the company is continuosly investing in long-term assets.

Cash inflows from investing activities are:

- Receipts from collections or sales of loans made by the enterprise and of other entities' debt instruments that were purchased by the enterprise (does not include those classified as cash equivalents)

- Receipts from sales of equity instruments of other entitites and from the returns of investments in those instruments

- Receipts from sales of property, plant, and equipment and other productive assts.

Cash outflows for investing activities are:

- Disbursements for loans made by the enterprise and payments to acquire debt instruments of other entities

- Payments to acquire equity instruments of other entities

- Payments to acquire property, plant and equipment and other productive assets

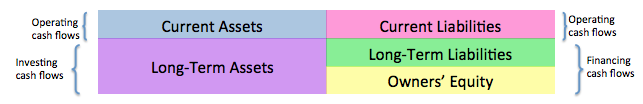

Financing activities: Financing activities of the company are those that affect the right hand side of the balance sheet. That is, a company must raise money to finance its investing and operating activities. A firm acquires resources by issuing equity or borrowing long-term debt. Over time, it may repurchase its own stock, pay dividends, or pay back long-term debt.

Cash inflows from financing activities are:

- Proceeds from issuing equity (issuing new shares)

- Proceeds from borrowing from a line of credit (LOC), bank loan, mortgage, notes, bonds or other short- or long-term borrowing

Cash outflows from financing activities are:

- Payments of dividends and the repurchase of shares

- Repayments of amounts borrowed

- Other principlal payments of long-term debt