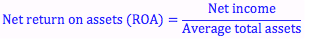

Return on assets (ROA) ratio is calculated by dividing the firm’s net income after interest and taxes by average total assets. Return on assets is important because a firm’s assets tend to represent the total value of the firm. If we look at the left hand side versus the right hand side of a balance sheet, we note that the firm’s total assets equal the firm’s debt plus equity. Knowing how efficiently management uses assets to create income is an important part of measuring managerial performance.

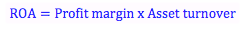

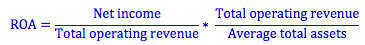

Often, we break down return on assets in terms of profit margin and asset turnover. In reality, firms often make decisions that accept a trade-off between profit margin and asset turnover. For example, a retailer could offer sales or lower prices that increase turnover but reduce profit margins.

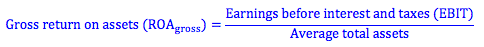

*If we wanted to calculate gross ROA we would use EBIT rather than net income here.

The intuition from these formulas is that firms can increase return on assets by increasing their profit margin or their turnover, or both. However, since we know there is often a trade-off between the two in real life, this is often easier said then done.

Return on Assets (ROA)

BrainMass Solutions Available for Instant Download

Return on Assets: profitability of S&J Plumbing Inc.

-Use the comparative analysis below for S&J Plumbing, Inc. to determine if S&J Plumbing's return on assets is comparable to its competitors in the same industry. -Support your answers. Please see attached chart.

Cash Conversion Cycle,ROA Model and Expenses Related to Sales

[Business Organization and Intellectual Property] Phil Young, founder of the Pedal Pushers Company, has developed several prototypes of a pedal replacement for children's bicycles. The Pedal Pusher will replace existing bicycle pedals with an easy-release stirrup to help smaller children hold their feet on the pedals. The Pedal

Sustainable Growth at a Firm

A firm wishes to maintain an internal growth rate of 4.5 percent and a dividend payout ratio of 60 percent. The current profit margin is 7.5 percent and the firm uses no external financing sources. What must the total asset turnover be?

Why Banks Have a Low ROA but a High ROE

Could you help with the following answer (in laymans terms): Why do banks have a low ROA (relative to other industries) but a high ROE?

Delta Roa

Delta Manufacturing is a decentralized corporation. Divisions are treated as investment centers. In recent years, Delta has been running about 11% ROA for the corporation as a whole and has a cost of capital of 9%. One of their most profitable divisions is Alpha Products, which last year had ROA of 17% ($1,700,000 operating i

Trend Analysis compared with DuPont Analysis

Debate the features of trend analysis in comparison with DuPont analysis as a method to study a firm's financial condition. response is 296 words

How might credit terms impact assets and ROA?

The CFO of PQR Inc. was advised by his credit manager to give better credit terms to new customers to induce sales. The CFO was concerned about the effects of doing the same on the financial statements, such as total assets and return on total assets. In your opinion, what could be the possible effects of following the advic

Operations Management/Value Chain Case Study: Rock of Ages

Rock of Ages Case Study This assignment is focused on operations strategy and management decision-making. "What do you recommend ROA do to address the management issues?" Include comments about the case you want to make from a management, strategic and/or capacity planning perspective. Identify the problems a

Eagle Company financial data: compute ROA, current ratio, acid-test, profit margin, inventory turnover, debt-equity ratio

Eagle Company Balance Sheet as of December 31 (millions) 2007 2008 2009 Assets Cash $2.6 $1.8 $1.6 Government securities 0.4 0.2 0 Accounts and notes receivable 8 8.5 8.5 Inventories 2.8 3.2 2.8 Prepaid assets 0.7 0.6 0.6 Total current assets $14.5 $14.3 $13.5 Property, plant, and equipemnt (net) 4

Performing a Financial Analysis for Coca-Cola

Please see attachment. Using the most recent financial information (income statement and balance sheet) for Coca-Cola that is found at www.yahoo.com (or you can use the information on the Thomson site), perform a financial analysis similar to that posted on the 1986-96 attachments. To access Coke's financial information from

ROA Case (Rock of Ages): Recommendations to management

See attached case file. What is the recommendation ROA do to address the following management issues: How did all the pieces fit together gicen the firm's new strategy? How did the quarry support manufacturing? How did manufacturing support sales? How did they all add value? How did they all work together to achieve a co

Banks and interest rates and capital requirements

Chapter 17 Questions 5. If you are a banker and expect interest rates to rise in the future, would you want to make short-term or long-term loans? 12. If a bank doubles the amount of its capital and ROA stays constant, what will happen to ROE? 15. If a bank is falling short of meeting its capital requirements by $1 millio

Define financial markets; distinguish between money & capital markets; break even

14-1 What are financial markets? What function do they perform? How would an economy be worse off without them? 14-3 Distinguish between the money and capital markets. 14-4 What major benefits do corporations and investors enjoy because of the existence of organized security exchanges? 15-12a (Break-even point) You are

How can firms in some industries receive a positive response from analysts and investors with return on assets (ROA) of 1 percent, while in other industries, an ROA of 10 percent is required?

Please respond with at least five sentences to each question 1. How can firms in some industries receive a positive response from analysts and investors with return on assets (ROA) of 1 percent, while in other industries, an ROA of 10 percent is required? 2. How would one determine the viability of a company by looking at its

The answer to Return on total assets

Question 36: Financial statements for Lardy Company appear below: Lardy Company Balance Sheet December 31, Year 2 and Year 1 (dollars in thousands) Year 2 Year 1 Current assets: Cash and marketable securities $ 166 $ 174 Accounts receivable, net 226 182 Inventory 190 188 Prepaid expenses 40 20 Total

Describing Current Ratio, Debt ratio, Profit Margin and ROA

Please describe Current ratio Debt ratio Profit margin ROA

A) What is the firm's sustainable growth rate? b) If the firm grows at its sustainable growth rate, how much debt will be issued next year? c) What would be the maximum possible rate if the firm did not issue any debt next year?

A company had net income of $2000 on sales of $50,000 last year. The company paid a dividend of $500. Total assets were $100,000, of which $40,000 was financed by debt. a) What is the firm's sustainable growth rate? b) If the firm grows at its sustainable growth rate, how much debt will be issued next year? c) What wou

Operating Ratios - Comment on the firm's changing liquidity across the three-year period

See the attachment. 20X1 20X2 20X3 current ratio 1.2 1.15 1.1 A/R turnover 15 16 17 Asset turnover 2 2.1 2.2 Profit margin 7% 7.50% 8% EPS $2.20 $2.30 $2.40 PE 11 12 13 Equity multiplier 2 2.1 2.2 Questions 1. Comment on the firm's changing liquidity across the three-year period. 2. What is

Ratios, ROA, profit margin, total assets turnover

You observe that a firm's profit margin is below the industry average, its debt ratio is below the industry average, and its return on equity exceeds the industry average. What can you conclude? a. Return on assets is above the industry average. b. Total assets turnover is above the industry average. c. Total assets turnover

Please Help- Ratios

Hello All OTA's, How can I get an OTA to help me with this question? How can I make this question more appealing to answer? I am writing to ask for major help. I am going through my textbook and completing study questions for a forthcoming exam. One of the questions is rather large, and has taken me a while to compose a

Financial Management - ROA

A firm has a profit margin of 15 percent on sales of $20,000,000. If the firm has debt of $7,500,000, total assets of $22,500,000, and an after-tax interest cost on total debt of 5 percent, what is the firm's ROA?

Requirements of Funds and Sales Growth

Assume that an average firm in the office supply business has a 6% after-tax profit margin, a 40% debt/asset ratio, a total assets turnover of 2 times, and a dividend payout ratio of 40%. Is it true that if such a firm is to have any sales growth, it will be forced either to borrow (take on debt) or sell common stock? Discuss.

ACCOUNTING [Business, Managerial]

ACCOUNTING [Business, Managerial] A firm's net profit margin is 3%, its financial leverage ratio is 2, and its asset turnover ratio is 4. The firm's return on assets is. a. 6% b. 8% c. 12% d. 24% A firm's net profit margin is 3%, its financial leverage ratio is 2, and its asset turnover ratio is 4.

Ratios

The following data are taken from the financial statements of Mercer Company. The data are in alphabetical order. Consider balances as averages if applicable. Accounts Payable $22,000 Net Income $48,000 Accounts Receivable $60,000 Net Sales $400,000

Describe and explain some of the useful links developed by the Dupont System for linking ROA and ROE with our fnancial ratios. Can you explain how the ratio

On Page 797 of the Brealey textbook, Brealey discusses how the Dupont System links Return on Assets (ROA) and Return on Equity (ROE) ratios with other financial ratios in useful ways. Describe and explain some of the useful links developed by Dupont System for linking ROA and ROE with other financial ratios. Can you explain how

Return on Equity/Assets

Desmond Ray's has annual sales of 600,000,000 Net after tax margin of 6% Sales to assets ratio of 5 What is its return on assets? If Debt/Equity ration is .05, what is the return on equity? Explain in excel

Z Corp Ratio Analysis: Current, ROA, EPS, quick, debt, PE, dividend yield

(See attached file for full problem description) --- Ratio Analysis Z Corp. Balance Sheet 12/31 2000 2001 Cash $ 100 $120 Accounts receivable 250 260 Inventory 400 500

Current Yield and Total Return

Microsystems Common Stock is selling for $80 per share and pays a cash dividend of $2.40 per share. How would you calculate the current yield? If the same stock is expected to rise to $86.40 in the nest year, what would be the total dollar amount return? The total expected rate of return investors can expect from this sto

What is Meryl Corporation's return on total assets (ROA)?

The Meryl Corporation's common stock is currently selling at $100 per share, which represents a P/E ratio of 10. If the firm has 100 shares of common stock outstanding, a return on equity of 20 percent, and a debt ratio of 60 percent, what is its return on total assets (ROA)? 8.0% 10.0% 12.0% 16.7% 20.0%