Financial accounting is the accounting discipline that looks at manipulating and presenting financial information for external users. These users include investors and creditors and other lendors, who use this information to make resource allocation decisions. Financial accounting must conform to applicable accounting standards, such as IFRS or US GAAP. These accounting standards require that companies prepare four financial reports every fiscal period: a balance sheet, an income statement, a statement of cash flows, and a statement of owner's equity. The standards are developed with the ultimate goal of improving the decision-usefulness of a firm's financial information.

The discipline of financial accounting began with the invention and proliferation of the double entry book-keeping system in the mid-fifteenth centruy. The double entry bookkeeping system is a system of accounting for transactions that requires two equal entries for every transaction. When the system was first developed, business operators used it to record transactions such as accounts receivable. These transactions were conceptually easy, since cash and accounts receivable have a physical and legal basis. When an account was collected, there would be an increase in cash equal to the decrease in the accounts receivable.

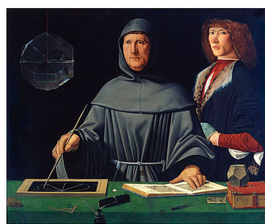

By 1494, a complete description of accounting had appeared, written by an Italian monk and mathematician Luca Paciolo. By Paciolo’s time, the double entry bookkeeping system had expanded to be able to handle transactions such as sales. When a good is sold, there is an increase in accounts receivable and a decrease in cost of goods sold - but what about the difference? Abstract concepts such as “income” had to be developed to handle this conceptual difficulty. (1) Paciolo defined income as the rate of change of capital in a business (we often call capital owners' equity). Using this definition, Paciolo outlined the Golden Rule of Accounting, that held that all transactions must be recorded in a way that balance, and that follow the accounting equation Assets = Liabilities + Owners' Equity.

Paciolo did not invent the system, but he did record in detail the double-entry bookkeeping system that had been developing over time. His work was eventually translated into English, and continued developing with the advent of the joint-stock company. As a result, external users began asking for accounting information to inform their investment decisions.

Other external users followed. In 1909, the United States introduced the corporate income tax. As a result, the government became an important stakeholder in the corporation, and required financial information to determine income and income taxes.

Another important external user is the US regulatory body the Securities and Exchange Commission. Founded in 1934 following the stock market collapse and Great Depression, the SEC is responsible for ensuring that financial reports meet disclosure-based standards in order to protect investors. However, the actual accounting standards required for reporting are delegated by the SEC to the Financial Accounting Standards Board (FASB) who are responsible for determining authoritative generally accepted accounting principles (GAAP) in the United States.

Since the 1970s, accountants have been working to harmonize accounting standards internationally, a project known as International Financial Reporting Standards (IFRS). Furthermore, since the financial scandals surrounding Enron, WorldCom and Arthur Anderson, we now see ethics, integrity and conflict of interest issues as paramount to address in order to preserve the reputation and value of the accounting profession.

(1) Paciolo on Accounting, by R. Gene Brown and Kenneth S. Johnston (1963)

- Business

- /

- Accounting

- /

Financial Accounting & Bookkeeping

BrainMass Categories within Financial Accounting & Bookkeeping

Accounting Standards

Accounting standards involve four levels of guidance for the preparation of financial accounting statements. The first level of general guidance comes from the conceptual framework of accounting. The second level of guidance is a series of basic GAAP, which are a number of assumptions, conventions, and principles derived from the conceptual framework of accounting that accountants follow. The third level of guidance is US GAAP, which is a codified set of rules and procedures determined by the Financial Accounting Standard Board (FASB) in the US. The third level of guidance comes from conventions developed as a part of generally accepted industry practices in accounting.

The Accounting Cycle

The accounting cycles shows how accounting information is collected, manipulated and presented on the financial statements. When a transaction occurs, accounting information is recorded as a journal entry and posted into the ledger accounts. At the end of the period, accountants prepare the unadjusted trial balance, record adjusting entries, prepare the adjusted trial balance, prepare the financial statements, record the closing entries, prepare a post-closing trial balance, and the cycle begins again.

Journal Entries

The general journal is a chronological record used to record all of the firm's transactions. When a transaction occurs, the first step in the accounting cycle is to record the transaction in the company's general journal.

Posting to Ledger Accounts (T-Accounts)

Every asset, liability and owners' equity account has what we call a

Trial Balance

Trial balances are prepared to ensure that we have made no errors in recording our transactions over the period and that we've posted each transaction correctly to the general ledger. The balances of all of the T-accounts are added together in the trial balance to ensure that the total debit balances equal the total credit balances at the end of the period.

Correcting Accounting Errors

If the trial balance does not balance, a number of tools and techniques are used to help us determine where an error may have been made. If necessary, correcting entries can be done to bring the T-accounts to the correct balances after the errors are found.

The Adjusting Process

Because we use an accrual basis, some accounts need to be reconciled at the end of the period. These accounting adjustments fall into three basic categories: deferrals, depreciation and accruals.

The Closing Process

Closing the books refers to preparing the books for the beginning of the next period in the accounting cycle. We do this by setting the revenue, expense and withdrawals accounts back to zero.

The Financial Statements

The financial statements are prepared to present financial information in an aggregate form to make it useful for external users. Preparing the financial statements is the sixth step in the accounting cycle and is done with the help of the worksheet.

Financial Ratios

Financial ratios are calculated based on information found in the financial statements. They help communicate the meaning behind the information presented on the financial statements and help users better evaluate the performance of the firm. Most financial ratios fall into one of four categories: solvency ratios, activity ratios, profitability ratios, and market value ratios.

Revenue Recognition

When accounting is done on a cash-basis, revenue is recognized when cash is received, regardless of when the sale of goods occurs. However, most accounting is done on an accrual basis. Under accrual accounting, according to the revenue recognition principle, revenues are recognized when they are realized, or realizable and earned. This makes the issue of when to recognize revenue one of the constant dilemmas in accrual accounting.

Cash

This section looks at the accounting treatment of cash. Cash is the most liquid asset. It is the standard medium of exchange for business transactions (except in bartering transactions). As well, since cash is currency, it is the basis for measuring and accounting for all business transactions and the related items that appear on the financial statements of a business.

Investments in Securities

This section looks at the accounting treatment of short-term investments in items such as cash equivalents and debt and equity securities.

Receivables

This section looks at the accounting treatment of financing receivables. Financing receivables (or simply receivables) are claims that a company has against customers and others for money, goods, or services. Understanding the proper accounting for receivables is especially important considering the ease by which receivables information can be manipulated for fraudulent purposes.

Purchases, Inventory and Cost of Goods Sold (COGS)

This section looks at the accounting treatment of purchases, inventory, and cost of goods sold. It includes inventory-measurement systems such as FIFO, LIFO, specific-unit cost and weighted average costs. It also looks at estimating inventories as well as writing down the value of inventories based on the lower of cost or net realizable value rule.

Accounting for Long-Term Assets

This section looks at the accounting treatment of long-term assets including property, plant and equipment, natural resources, and intangible assets such as goodwill and research and development costs. It also looks at depreciation methods.

Accounting for Liabilities

This section looks at the accounting treatment of liabilities including current and long-term liabilities.

Accounting for Corporations

This section looks at the accounting treatment of transactions relating to corporations including issuing and repurchasing shares, paying dividends and accounting for corporate income tax.

Accounting for Partnerships

This section looks at the accounting treatment of transactions relating to proprietorships and partnerships including contributions and withdrawals from owner’s equity and special considerations for partnership accounting.

BrainMass Solutions Available for Instant Download

Working Capital & Cash Management in the Health Care Industry

In Essentials of Healthcare Finance: What is working capital and how would you calculated it? How they can improve their working capital? What are the great approaches for cash management? If you are the controller who is in charge of managing cash, what methods would you take and why?

Computation of Corporate Income tax

Suppose that a corporation has a taxable income of $325,000. What's the firm's corporate income tax for the current tax year? (You can use the following table to calculate the firm's U.S. federal corporate tax.) US Federal Corporate Tax Table Taxable Income Taxable Income Tax Rate More Than Less Than $0 $50,000 15% $5

New book value per share upon equity issue

JL Enterprises has 75,000 shares of stock outstanding, with a book value of $900,000 and a market value of $1,320,000. The firm is considering a project that requires the purchase of $130,000 in fixed assets and has a net present value of $7,500. The project would be all-equity financed through the sale of shares. What will the

Earnings per share calculations (net loss, continuing operations, stock dividend)

On December 31, 2015, Ainsworth, Inc., had 600 million shares of common stock outstanding. Twenty million shares of 8%, $100 par value cumulative, nonconvertible preferred stock were sold on January 2, 2016. On April 30, 2016, Ainsworth purchased 30 million shares of its common stock as treasury stock. Twelve million treasury sh

Super Hero Theme Park Financial Statements

The Super Hero Theme Park was started on January 1 of the current year by Dr. Strange. The following selected events and transactions occurred during: 1-Jan Jack Strange, the owner, invested $50,000 in the business. 5-Jan Purchased equipment for $100,000 on account from The Gotham Company. 8-Jan Incurred advertising expens

Stock option plan

Walters Audio Visual, Inc., offers a stock option plan to its regional managers. On January 1, 2016, options were granted for 40 million $1 par common shares. The exercise price is the market price on the grant date, $8 per share. Options cannot be exercised prior to January 1, 2018, and expire December 31, 2022. The fair value

Discuss Factors Influencing a Dividend Policy

Discuss the factors that influence a firm's dividend policy. Which factors are most important in formulating the dividend policy? Why?

Times-Roman Publishing Company: Deferred Taxes

See attachment. Times-Roman Publishing Company reports the following amounts in its first three years of operation: ($ in 000s) 2016 2017 2018 Pretax accounting income $250 $240 $230 Taxable income 290 220 260 The difference between pretax accounting income a

Non interest-bearing installment note

At the beginning of 2016, VHF Industries acquired a machine with a fair value of $6,074,700 by issuing a four-year, noninterest-bearing note in the face amount of $8 million. The note is payable in four annual installments of $2 million at the end of each year. Required: 1. What is the effective rate of interest implicit in

Lease with Guaranteed Salvage: Journal Entries, Amort Schedule

Shamrock Company leases an automobile with a fair value of $13,171 from John Simon Motors, Inc., on the following terms: 1. Non-cancelable term of 50 months. 2. Rental of $260 per month (at the beginning of each month). (The present value at 0.5% per month is $11,535.) 3. Shamrock guarantees a residual value of $1,770 (the

Comparing Accounting Income and Taxable Income

Dixon Development began operations in December 2016. When lots for industrial development are sold, Dixon recognizes income for financial reporting purposes in the year of the sale. For some lots, Dixon recognizes income for tax purposes when collected. Income recognized for financial reporting purposes in 2016 for lots sold thi

Belinda's Bagels Inc.'s (BBI) Unadjusted Trial Balance

This is an excerpt from Belinda's Bagels Inc.'s (BBI) unadjusted trial balance for its December 31 20X4, year-end financial statement are as follows: Belinda's Bagels Inc. Unadjusted trial balance (excerpts) Dec 31, 20X4 DR ($) CR ($) Prepaid Insurances 15,600 Invent

Ratios, Scattergraph and Net Present Value Computation

A corporation has the following balance sheet items for the year ending December 31, 2011: Cash $15,000 Accounts Receivable 20,000 Inventory 45,000 Prepaid Expenses 10,000 Property Plant and Equipment 80,000 Total Asset

Ethical Dilemma: Camp Industries

You are Chief Financial Officer of Camp Industries. Camp is the defendant in a $44 million class action suit. The company's legal counsel informally advises you that chances are remote that the company will emerge victorious in the lawsuit. Counsel feels the company will probably lose $30 million. You recall that a loss cont

Fixed Costs, Net Income, Capital Plan, & Utilization Reduction

Fixed Costs, Net Income, Capital Plan, & Utilization Reduction Assume that Valley Forge hospital has only the following three payer groups: Payer # of Admissions Avg. revenue/admission Variable cost/admission PennCare 1,000 $5,000 $3,

Triple Creek Hardware: Strength of a Perpetual Inventory System

Triple Creek Hardware Store currently uses a periodic inventory system. Kevin Carlton, the owner, is considering the purchase of a computer system that would make it feasible to switch to a perpetual inventory system. Kevin is unhappy with the periodic inventory system because it does not provide timely information on inventory

Funkie Video Inc.

Activity 2 FunkieVideo.com, a hypothetical start-up, opened for business on April 1 this year. FunkieVideo.com allows anyone to upload short personal videos, on which viewers then vote each month. The videos with the most votes will receive cash and other rewards, with a "grand prize" in a runoff among the winning monthly vid

Introduction to accounting and bookkeeping

Hello, this is my first time using Brainmass. I have become stuck on an accounting and bookkeeping module I have taken also for the first time. I have made some progress, but have now hit a brick wall and have a limited time to get the end if module assessment submitted. I would like your help with this subject area, but not req

Practice exam questions: Earnings per share, basic and diluted

11. In calculating diluted earnings per share, which should be included: a. The weighted average number of preferred shares outstanding. b. Undeclared dividends on nonconvertible noncumulative preferred shares. c. The amount of cash dividends declared on common shares. d. Common shares resulting from the assumed conversion o

Information Needs of Users Based on Qualitative Characteristics

The objective of general purpose financial reporting is to provide financial information about the reporting entity that is useful to users of financial statements...in making decisions about providing responses to the entity (IFRS, 2013). I need you help me to (a) Discuss the information needs of users in terms of the qual

Employees and Payroll

In bookkeeping there are four types of employees you should know and there are five categories of pay they can receive. List them with a brief description.

Tomas Co: Depreciation & asset disposal journal entries

Show the journal entries for the following, including any entries to depreciation to update through date of disposal. Assume straight-line method and that depreciation was last recorded on Dec 31, 2013. Jan 1, 2014: Tomas Company disposed of a piece of machinery that was purchased on January 1, 2004 . The machine cost $60,4

Activity-Based Costing: Unit Product Cost

Larner Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains the following six activity cost pools and activity rates: Activity Cost Pool Activity Rates Labor-related $ 7.30 per direct labor-hour Machine-related $ 2.96 per machine-hour Machi

Individual Taxation: Practice Exam Questions

1. Which of the following taxes are proportional (rather than progressive)? a. State general sales tax. b. Federal income tax. c. Federal estate tax. d. Federal gift tax. 2. Burt and Lisa are married and live in a common law state. Burt wants to make gifts to their four children in 2014 and plans to use the election to

Comparison of liabilities between different organizations

Consider three different businesses: 1. A Bank 2. A Magazine publisher 3. A department store For each business, list all of its liabilities - both current and long-term. Then compare the three lists to identity the liabilities that the three businesses have in common. Also identity the liabilities that are unique to each

Impact of Transactions on T-Accounts

During the year 2015, the company had the following summarized activities: a. Purchased short-term investments for $10,000 cash. b. Lent $5,000 to a supplier who signed a two-year note. c. Purchased equipment that cost $18,000; paid $5,000 cash and signed a one-year note for the balance

ABC Corp: Compute Ending Retained Earnings 2007

During 2007, ABC had sales of $93,054. Cost of goods sold, administrative expenses and selling expenses, and depreciation expenses were $31,629, $7,194, and $7,635, respectively. In addition, the company had an interest expense of $4,406, and a tax rate of 37%. The company paid$2,399 as dividends. If the retained earnings is 200

Impact of Interest Rates on Bond Value

Time Value of Money. 1. If you were to win $1,000,000 in the state lottery and had a choice to either receive $50,000 a year for 20 years or $560,000 now, which would you choose and why? What factors would you need to consider? 2. Construct some simple examples to illustrate your answers to the following: a. If interes

Discussion on contingent liability

While I found it very interesting to focus on a specific aspect of financial accounting that is not clear-cut, the conclusive determination that contingency liabilities must be properly valued is quite compelling. As our courts have gone about slicing up the merits that distinguish between what is reasonable suspicion and prob

Inventory Errors in Books of Account

There may be instances of incorrect recording of inventory data in the books of account. As closing inventory is carried forward in the general ledger of the next accounting period, as opening inventory, an incorrect recording of inventory in one accounting period can affect the accounts of the subsequent period. Consider the