Convertible bonds or convertible debentures are bonds that have an option to be converted into a fixed number of common shares of the issuing company up until the date of maturity of the bond. Unlike bonds with warrants, which can be separated in two distinct securities, convertible bonds cannot. A share of convertible preferred stock is the same as a convertible bond, except preferred stock does not have an expiration date. The option to convert the bond to stock makes the security more attractive, and allows the issuing company to pay less interest (or dividends, in the case of preferred shares).

Often issuing firm's have a call option on the convertible bonds outstanding. The is, when an issuing firm chooses for, the can call in the convertible bonds. When the bonds are called, bond holders typically have 30 days to choose whether to convert the bonds to common stock at the conversion ratio or receive a

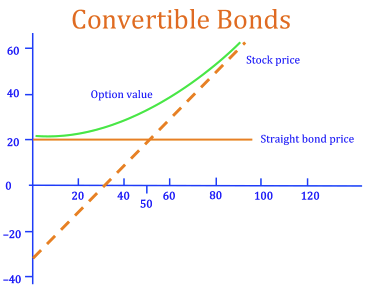

The value of a convertible bond is made up of three components: straight bond value, conversion value, and option value.

Straight Value of the Bond: The straight bond value is the value that the bonds would normally be sold for without the conversion option. The straight bond is found by discounting the cash flows of the bond using a discount rate that reflects the risk-free interest rate and the firm's default risk.

Conversion Value: The conversion value is the value that the bond would be worth if it was converted into stock. The conversion value can be easily found by multiplying the number of shares we would receive upon conversion by the price of the stock. The conversion ratio is the number of shares a bondholder would receive of common stock for each bond held.

Option Value: The option to delay conversion provides extra value for the bondholders. This is because bondholders can wait and see which option will be more beneficial (converting or staying) and may convert at a future time if the price of the underlying stock rises.

We see from the above diagram that the price of a convertible bond closely matches the price of the straight bond when the convertible bond is "out-of-the money," that is, when the call price of the convertible bond is greater than the current stock price. However, when it is "in-the-money," the price of the convertible bond closely resembles the price of the underlying stock.

Black-Scholes Method

A simple method for valuing the convertible bond involves taking the straight value of the bond and adding to it the price of the warrant (see Warrant Pricing). Using this approach, we can use the Black-Scholes model to value the warrant, and find the sum of this value and the value of the bond. However, this approach does not take into account important features of convertible bonds, such as issuer calls.

Binomial Option Pricing Model

For convertible bonds with issuer calls, investor puts and conversion rate resets, binomial pricing is used.

Photo by Sven Hornburg on Unsplash

© BrainMass Inc. brainmass.com April 17, 2024, 8:18 pm ad1c9bdddf