The adjusted present value (APV) method is a model that shows how the value of a project to the levered firm (the adjusted present value) is equal to the value of the project to an unlevered firm (NPV) plus the net present value of the financing side effects (NPVF), or the net present value of financing. As a formula:

There are four major considerations for the APV method: the tax subsidy to debt, the cost of financial distress, the cost of issuing new securities, and the subsidies to debt financing. While each of these four factors are important when calculating the NPVF, the tax subsidy to debt is by far the most important. In practice questions, we typically look most closely at the tax subsidy to debt when calculating NPVF.

Tax subsidy to debt: For perpetual debt (that is, assuming that the firm maintains the same capital structure, simply rolling over its current debt into new borrowing) the value for the tax subsidy is equal to TCB (where TC is the corporate tax rate times, and B is the value of debt).

Costs of financial distress: The chance of the firm entering financial distress implies costs, which lower the value of the financing side effects.

Costs of issuing new securities: Those who participate in helping a firm issue new securities must be compensated for their time and effort, a cost that lowers the value of financing.

Subsidies to debt financing: Often corporations are encouraged to undertake projects by governments by being offered loans at interest rates below market value. The lower cost of borrowing is a subsidy that increases the value of financing.

Using the Formula:

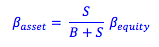

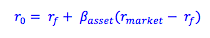

NPV: We use ro, the expected return to equity of an unlevered firm, and the unlevered cash flows (the expected cash flows after tax, but before interest payments), to calculate NPV. If it is not given in the question, we can find the expected return to an unlevered firm by taking the observed beta of the levered firm (Bequity), and finding the corresponding beta for the firm if it was all equity (Basset). We can then plot the asset beta on the security market line to find the expected return of the firm if it was all equity.

NPVF: The present value of the financing side effects can typically simply be found by finding the tax shield from the debt financing of the project, calculated in perpetuity.

NPVF = TCB

Therefore,

- Business

- /

- Finance

- /

- Capital Budgeting

- /

Adjusted Present Value (APV) Approach

BrainMass Solutions Available for Instant Download

Legal Issues and Managerial Finance

Consider a financial situation that has the capacity to test your faith or stretch the boundaries of what might be considered as legal., or choose a situation you have experienced personally and write as a narrative, You can also select a case to analyze.) Write a 1200-1500 word paper describing the situation and your thought

Modigliani and Miller Propositions, Puppeteers, Major Capital Structure Changes, and Financial Formulas

1. Compare and contrast the Modigliani and Miller propositions with the Weighted Average Cost of Capital (WACC) approach. 2. According to the textbook author (find reference below), what is a puppeteer? Are puppeteers important to the financial process? Are puppeteers functioning in a good or evil manner? Justify your response.

Dorchester, Ltd: Economic Assessment For Operation Expansion

Dorchester Ltd. is an old-line confectioner specializing in high-quality chocolates. Through its facilities in the United Kingdom, Dorchester manufactures candies that it sells throughout Western Europe and North America (United States and Canada). With its current manufacturing facilities, Dorchester has been unable to supply t

Constant Interest Coverage Policy

What is a constant interest coverage policy and how does it impact the levered value of a project?

Consider a Project to produce solar water heater: Calculate APV

Consider a project to produce solar water heaters. It requires a $10 million investment and offers a level after-tax cash flow of $1.75 million per year for 10 years. The opportunity cost of capital is 12 percent, which reflects the project's business risk. Suppose the project is financed with $5 million of debt and $5 millio

Adjusted present value method undertake the project

Can you help me get started with this assignment? APV Gemini, Inc., an all-equity firm, is considering a $2.4 million investment that will be depreciated according to the straight-line method over its four-year life. The project is expected to generate earnings before taxes and depreciation of $850,000 per year for four years

APV, Unlevered cost of capital, Debt=equity ratio

A firm has a cost of equity of 13.8% and a pre-tax cost of debt of 8.5%. The debt-equity ratio is .60 and the tax rate is .34. What is the firm's unlevered cost of capital? a. 8.83% b. 12.30% c. 13.97% d. 14.08% e. 14.60% Your firm has a pre-tax cost of debt of 7% and an unlevered cost of capital of 13%. Your tax ra

Behavioral Finance - Computing APV for AutoNation

AutoNation is contemplating a project that requires a $350 million intial outlay and features an NPV of $48 million. The firm is all-equity financed and has $150 million in cash that it plans to invest in the project. AutoNation's current market value of equity is $3.4 billion. AutoNation could raise $200 million of external fi

Compare and Contrast

Compare and contrast the APV, FTE and WACC approaches to valuation.

Investment Management Base-Case NPV

(The following information relates to Questions 28 to 31) A project's after-tax operating cash inflows are $175,000 per year for each of the next four years. The initial investment is $500,000. The unlevered cost of equity capital is 15%. The risk-free interest rate is 7% 28. What is the base-case NPV? A) $750 B) -$37

Adjusted Present Value: Calculate the value of Company B's equity to Company A

Company A, is considering purchasing a smaller chain, Company B. Company A's analysts project that the merger will result in incremental free cash flows and interest tax savings of $2 million in Year 1, $4 million in Year 2, $5 million in Year 3, and $117 million in Year 4. The Year 4 cash flow includes a horizon value of

Mergers & Acquisitions: Analysis w/ Regression Work for Viacom and Paramount

Viacom and QVC's competition for Paramount - Brief Overview After a week or so of rumors, Viacom made an offer for Paramount Communications of $68.42 a share on September 10, 1993. Ten days later, QVC made a tender offer for Paramount of $83.13 a share. Both offers were a mixture of stock and cash with the estimated offer pr